On 11/22/24 Bitcoin (BTCUSD) reached 99,860 close to a major round number 100,000. Could this number represent significant resistance? An examination of BTCUSD history reveals some fascinating data.

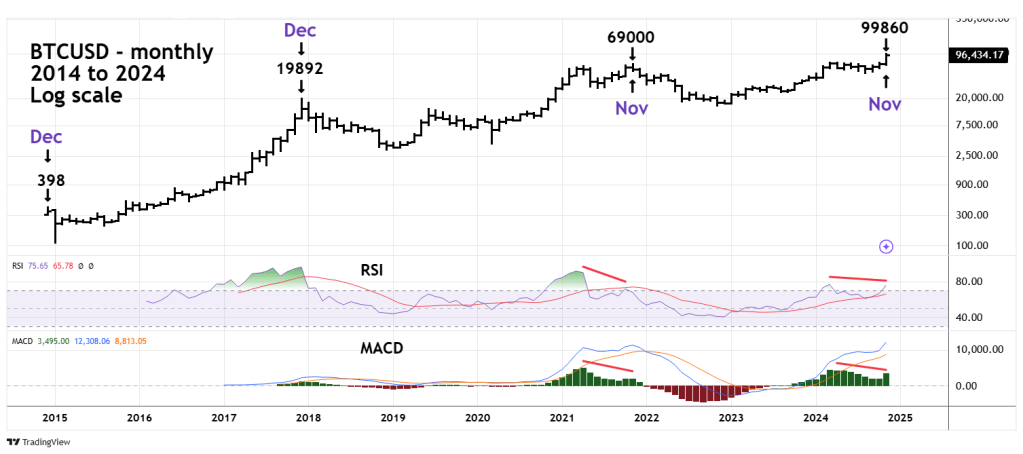

The monthly BTCUSD chart courtesy of Trading View shows the long-term view since its inception in December 2014.

Each of the three important BTCUSD peaks came close to or at important round numbers.

The December 2014 high was at 398 only two points from 400.

Three years later in December 2017 BTCUSD hit 19,892 only 108 points from 20,000.

Almost four years later BTCUSD reached round number 69,000. Although an argument could be made that 70,000 was the real round number target.

The most recent high was only 140 points away from the magnificent 100,000!

Also please note the seasonal topping pattern. The first two peaks occurred in December, the third in November. The recent high is in November with only one week until December.

Of the three peaks December 2014 is the most fascinating. BTCUSD began trading 12/01/14. Made its 398 high on 12/10/14 then had a rapid 72% decline into 01/14/15. Welcome to Bitcoin!

After the next top in December 2017 – BTCUSD went into a one year 83% drop before bottoming in December 2018.

Subsequent to the November 2021 peak BTCUSD fell 77% and bottomed out in November 2022. Please note each bear market lasted one year.

Monthly RSI and MACD – Histogram have bearish divergences.

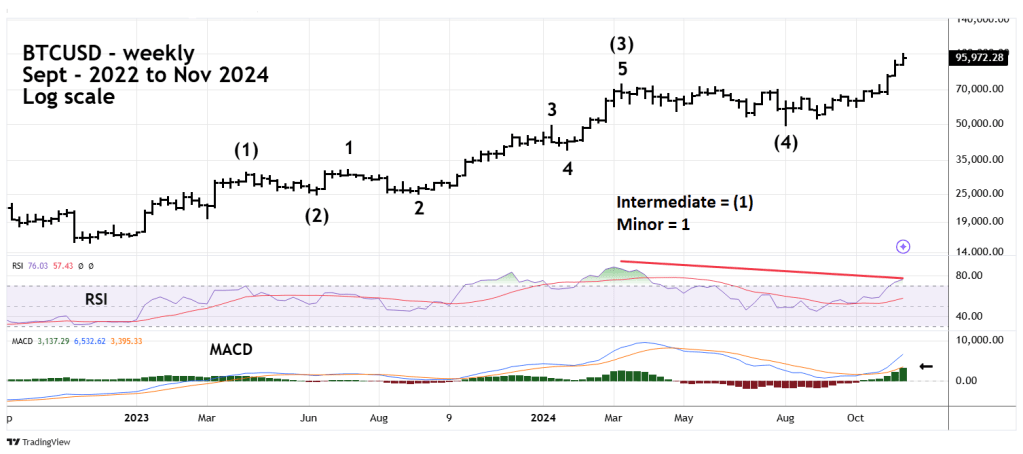

The weekly BTCUSD chart illustrates the action since the November 2022 bottom.

Similar to both the Dow Jones Industrial Average and the S&P 500, an Elliott wave extended Impulse pattern appears to be forming. The presumed Intermediate wave (5) does not look complete, which implies more upside action.

This theory is supported by the weekly MACD – Histogram which has no bearish divergence. However, weekly RSI does have a bearish divergence.

Potential round number resistance, seasonal topping patterns, and Elliott wave structure imply BTCUSD is in the area of an important top.