The 11/23/25 blog “Is History Repeating?” noted.

“Corrections of the main trend are usually choppy, and that’s what’s happened so far in the November drop. The move down looks like an Elliott wave – Double Zigzag correction”.

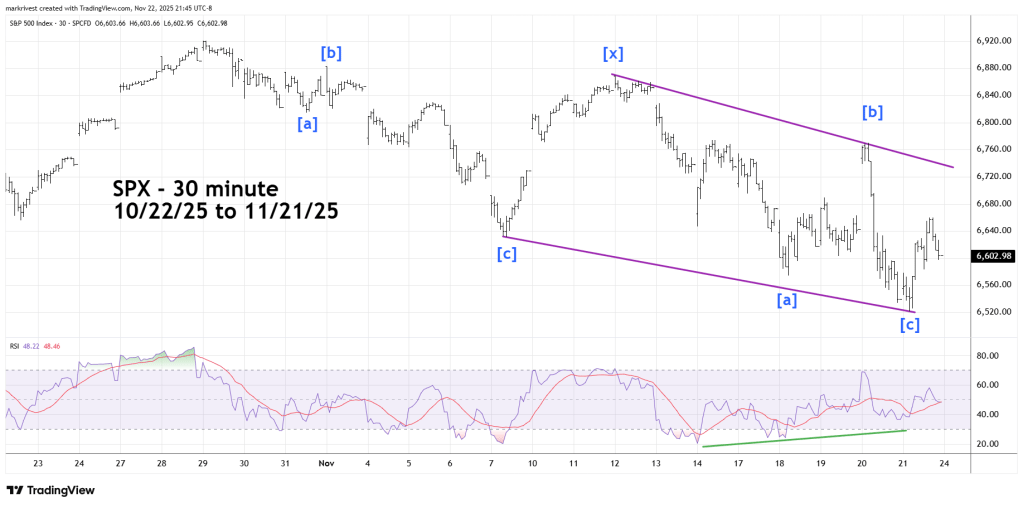

The 30-minute S&P 500 (SPX) chart from that blog is shown below.

The 11/23/25 blog also noted.

“Intraday momentum supports the bullish scenario. The 30 – minute RSI has several bullish divergences implying that the selling is exhausted. There’s a good chance SPX could rally in the next few trading days”.

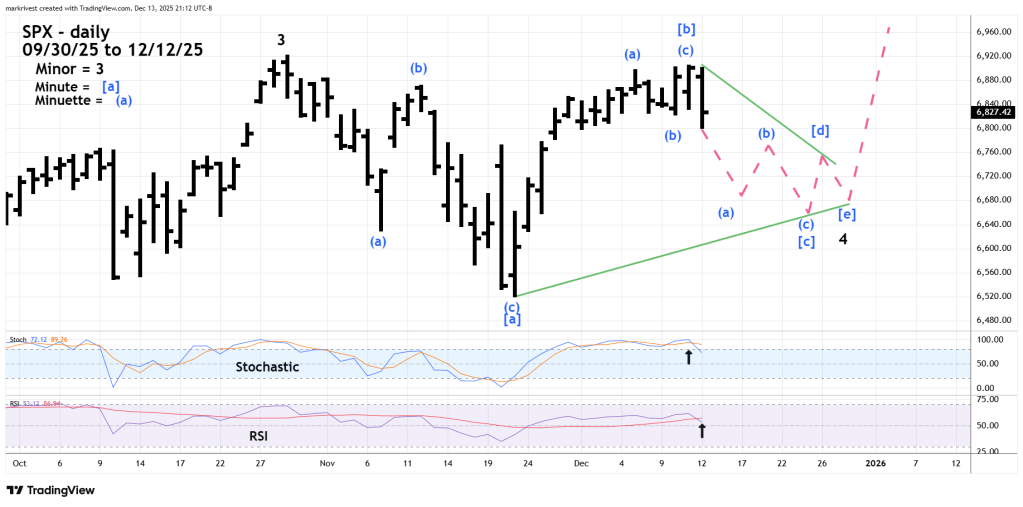

Subsequently the SPX rallied into a peak on 12/11/25. The daily SPX chart courtesy of Trading View updates the action.

For simplicity the October to November decline – Elliott wave – Double Zigzag correction is condensed to a Single Zigzag. On an intraday basis the rally after the November bottom also counts as Double Zigzag. This movement is also condensed to a Single Zigzag.

An Elliott wave – contracting Horizontal Triangle could be developing from the SPX 10/29/25 peak.

These structures are net sideways corrections that subdivide into five waves, each of which further divide into three waves or a combination of three waves.

A common characteristic of contracting Horizontal Triangles is wave “b” usually comes close to the point of origin of wave “a”, which in this case – the SPX 10/29/25 peak.

Daily momentum oscillators suggest that Minute wave [c] – down of the presumed Horizontal Triangle may have begun. Daily Stochastic has a bearish line cross in the overbought zone. Daily RSI has crossed below its moving average line.

Waves “d” and “e” of Horizontal Triangles are frequently much smaller in size relative to the first three sub waves. For simplicity the three wave subdivisions of Minute wave [d] and [e] are not shown. If the Horizontal Triangle does develop it could end sometime in late December. After conclusion of a Horizontal Triangle there’s usually a thrust in the direction of the main trend, in this case up. The post triangle thrust would likely exceed the SPX 10/29/25 peak

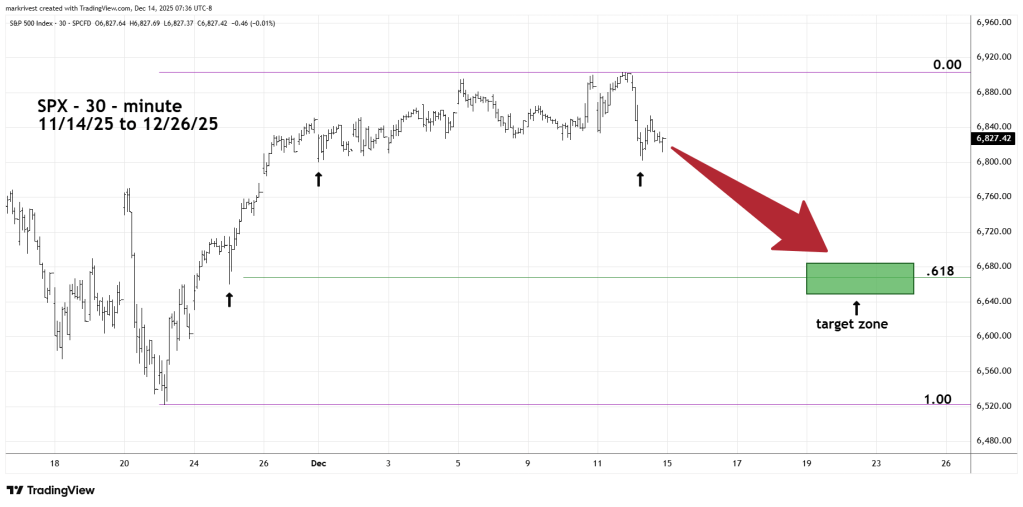

The 30 – minute SPX chart zooms in on the next possible support zone.

Note the double bottom close to 6,800, below which is “air” – no significant prior chart support. The sharp correction near 6,660 is close to a Fibonacci .618 retracement of the November to December rally. This is a logical area where Minute wave [c] of the presumed Horizontal Triangle could end.