Comparing November 2021 with November 2025

This website’s prior blog examined S&P 500 (SPX) November seasonal patterns. November 2025 – SPX decline is like what happened in November 2021. A repeat of that prior drop could happen in late 2025.

The daily SPX chart courtesy of Trading View illustrates what happened late 2021 to early 2022.

The 5.26% drop from late November 2021 into early December 2022 was the setup for the final bull market move into early January 2022. Subsequently SPX went into a multi-month bear market the did not end until October 2022.

Please note the daily RSI near the end of November 2021 never reached the oversold zone which begins at 30.00. The RSI maximum downside reading was 37.49.

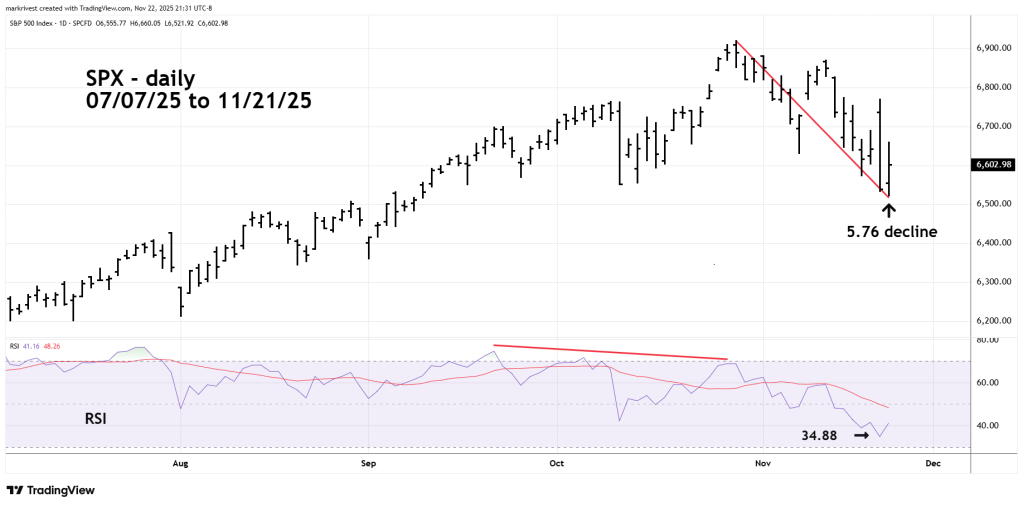

The next daily SPX chart looks at what happened in November 2025.

The decline so far of 5.76% is close to what happened in November 2021. The maximum downside RSI of 34.88 is also close to the November 2021 maximum of 37.49.

The most bullish factor of the November 2025 drop is the price pattern.

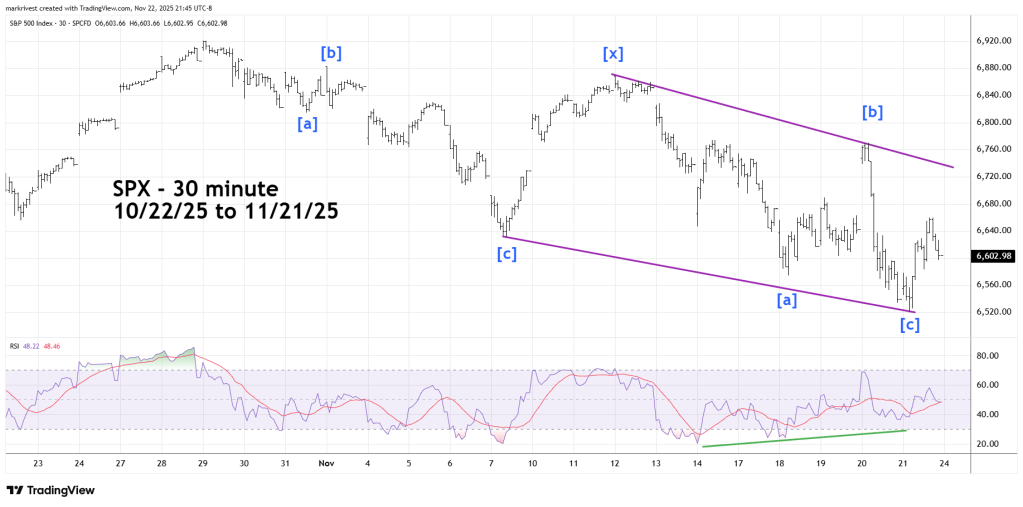

The 30 – minute SPX chart examines a possible bullish Elliott wave count.

Corrections of the main trend are usually choppy, and that’s what’s happened so far in the November drop. The move down looks like an Elliott wave – Double Zigzag correction.

Frequently in these wave structures the sub waves can also divide into Single or Double Zigzags. Please note that the final part of the decline from 11/20/25 to 11/21/25 labeled [b] to [c] subdivides into a Double Zigzag.

Intraday momentum supports the bullish scenario. The 30 – minute RSI has several bullish divergences implying that the selling is exhausted. There’s a good chance SPX could rally in the next few trading days.

Recent blogs on this website have noted that longer-term momentum and sentiment evidence indicates the post April 2025 rally could be near an end or has already terminated.

If SPX can reach a new all-time high in late 2025 it could be a gift for the bears.