At 10:00 AM – EDT on 08/22/25 the text of FOMC chairman Powell was released. The U.S. stock market immediately had a huge rally which could be the climax of the bull market that began on 04/07/25.

Markets sometimes turn on New/Full Moons plus or minus two trading days. There’s a New Moon on Saturday 08/23/25. The lunar time cycle tends to be more effective in highly emotional markets.

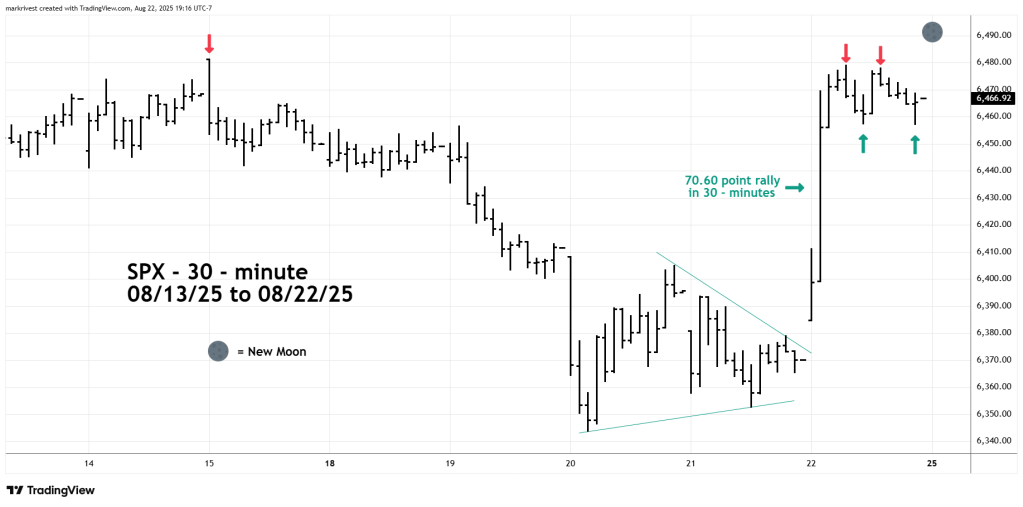

The 30 – minute S&P 500 (SPX) chart courtesy of Trading View shows what happened.

The news on 08/22/25 triggered a 70.60 point – 30 – minute rally in the SPX. About 80% of that move took place in only 5 – minutes, a highly emotional move. This 30 – minute rally was the second largest 30 – minute rally within the SPX trading hours since 04/07/25. The largest 30 – minute rally since 04/07/25 occurred on 04/09/25 which was a 350.10-point move up.

The 04/09/25 rally was triggered by President Trump’s tariff extension announcement. This was the kickoff of a multi- month bull move. Perhaps the 08/22/25 huge move up could be the climax?

On 08/22/25 only the Dow Jones Industrial Average made a new all-time high. The SPX and Nasdaq Composite failed to reach new highs – a potentially important bearish divergence.

The SPX all-time high on 08/15/25 was 6,481.31, the high on 08/22/25 was 6,478.89. Soon after the SPX reached a lower high at 6,477.99.

After the huge rally there was a small decline that reached 6,457.34 later a second small decline reached 6,457.13.

On the very short-term this is a series of lower peaks and lower bottoms – a bearish configuration.

On 08/25/25 if the SPX fails to exceed the peak at 6,478.89 a move below 6,457.13 could be very bearish.

Also 08/25/25 is the thirty – eighth anniversary of the bull market peak made in August 1987. That peak was the prelude to the October 1987 crash.