On 05/01/25 the S&P 500 (SPX) rallied into a major resistance zone and then turned down. An important peak for U.S. stocks could be in place.

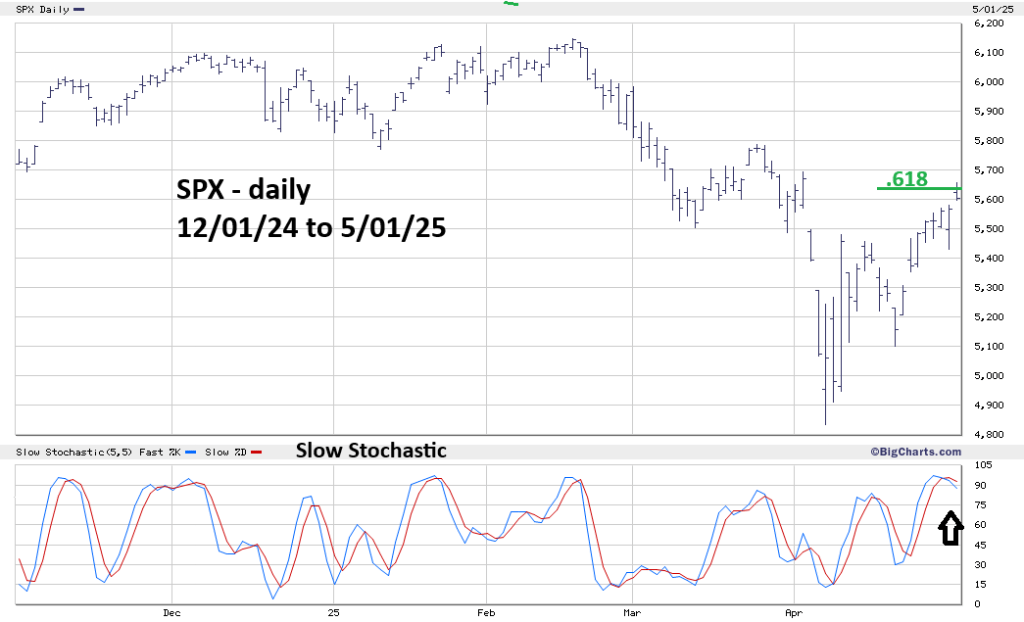

The daily SPX chart courtesy of BigCharts.com updates the action.

This website prior blog illustrated SPX – Volume Profile and Fibonacci analysis illustrated that there was Volume Profile and Fibonacci analysis in the 5,660 to 5,620 zone. A Fibonacci .618 retracement of the February to April decline is 5,650. The SPX high on 05/01/25 was 5,658.91

Daily Slow Stochastic reached the overbought zone above 80.00 and has a bearish line cross.

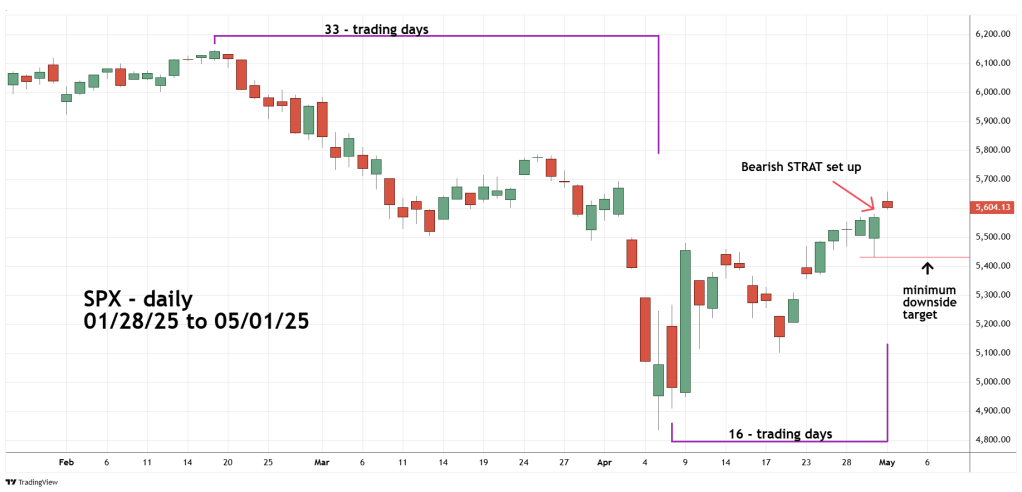

The daily SPX chart courtesy of Trading View illustrates a potential Fibonacci time cycle.

The SPX rally from 04/08/25 to 05/01/25 was 16 – trading days. The decline from 02/19/25 to 04/07/25 was 33 -trading days. A ratio of 16/33 or approximately 1 / 2.

There’s also a potentially bearish STRAT set up. The 04/30/25 session was an outside day followed by a marginally higher session bar on 05/01/25. If the SPX on 05/02/25 does not move above the 05/01/25 high and breaks below the 05/01/25 session low, it targets a move to the 04/30/25 session low.

A move below the SPX – 04/30/25 session low could be very bearish.

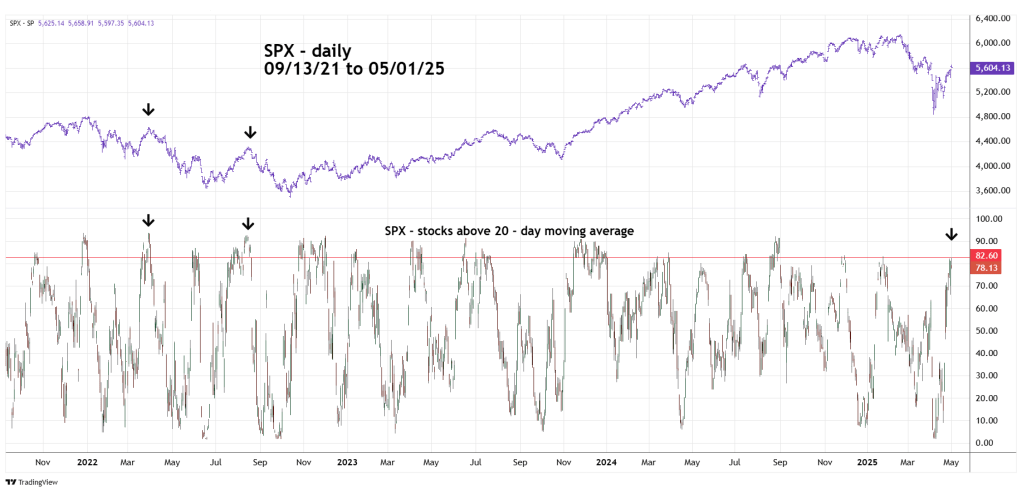

The next daily chart shows SPX stocks above the 20 – day moving average.

The 04/27/25 blog “Short-Term Outlook for U.S. Stocks – 04/25/25” illustrated that during the 2022 bear market SPX stocks above the 20 – day moving average during the March and August bear market rallies had readings above 90. The reading on 05/01/25 was 82.60. This could mean the SPX rally has further to go, or the current SPX strength is weaker than the 2022 bear market.

We could have an answer very soon. U.S. monthly employment report is due at 8:30 AM – EDT 05/02/25.

Personal note. I will be on a vacation trip for the next several days. The next blog for this website will be 05/08/25.