The U.S. stock market peaks in 2000, 2007, and 2022 occurred with only one of the three main U.S. stock indices making a new bull – market top. I call this phenomenon a “Rule of Majority” signal. The three main U.S. stock indices are the S&P 500 (SPX), Dow Jones Industrial Average (DJI) and the Nasdaq Composite (IXIC).

On 12/09/24 the IXIC made a new all-time high unconfirmed by the SPX and DJI.

On 12/10/24 IXIC again made a new all-time high unconfirmed by the SPX and DJI.

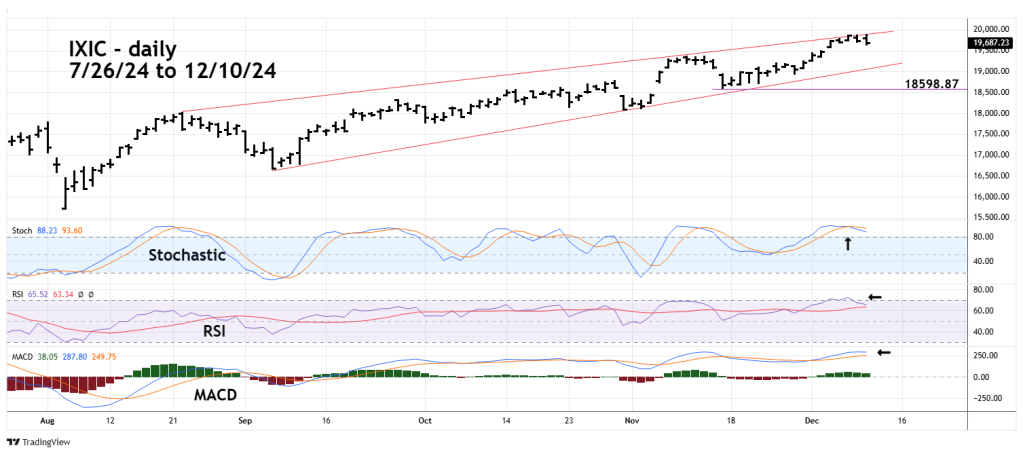

Throughout most of 2024 there have been several failed bearish momentum signals, so far the “Rule of Majority” signals have resulted in only short-term tops. The daily IXIC chart courtesy of Trading View illustrates important support levels.

The largest IXIC bear move in 2024 was a 15.9% drop from July to August.

Two near term levels to watch are:

1) Rising trendline connecting the 09/06/24 and 10/31/24 bottoms.

2) Bottom made on 11/15/24 at 18,598.87.

A break below these important support levels could open the door for at least a 15% decline.

Daily Stochastic has a bearish lines cross.

RSI reached the overbought zone above 70.00 but did not have a near term bearish divergence.

MACD so far has no bearish lines cross.

A move below IXIC 18,590 could trigger a mini crash back to the August 2024 bottom.