May, 6 2024 could be an important day for the Russell 2000 (RUT) and the U.S. stock market. A strong move up could open the door for the RUT and other U.S. stock indices to make new 2024 highs. A significant move down implies a resumption of the decline that began in late March 2024.

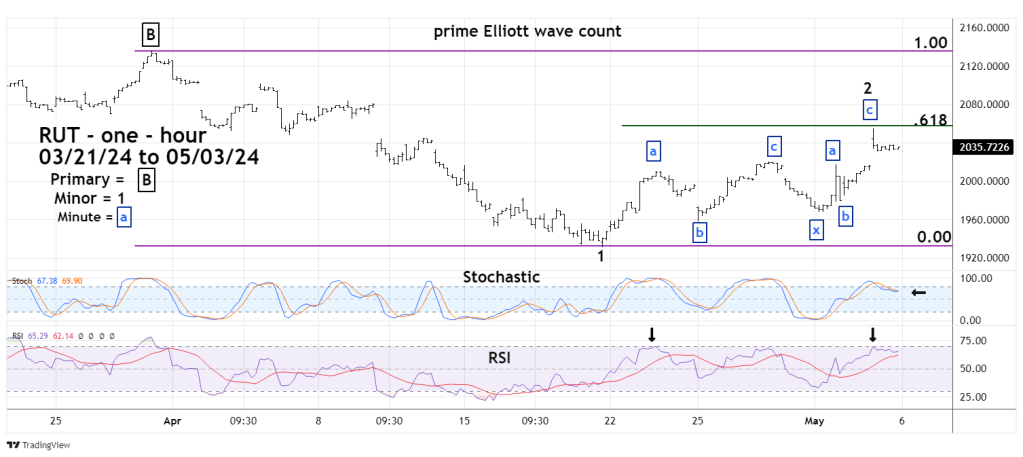

The one – hour RUT chart courtesy of Trading View illustrates its prime Elliott wave count.

In this wave interpretation RUT appears to have completed an Elliott wave Double Zigzag correction of the 03/28/24 to 04/19/24 down move. Note that the rally terminated just below a Fibonacci .618 retrace of the March to April decline.

Momentum indicators support the theory that a counter trend rally may have peaked on 05/03/24.

One – hour Stochastic had a bearish lines cross in the overbought zone.

On 05/03/24 RSI had a marginal bearish divergence. The RSI reading on 05/03/24 was 69.56 vs. the RSI 04/23/24 reading of 69.71.

Important support is the 05/01/23 bottom at 1,979.47 labeled Minute wave “b”.

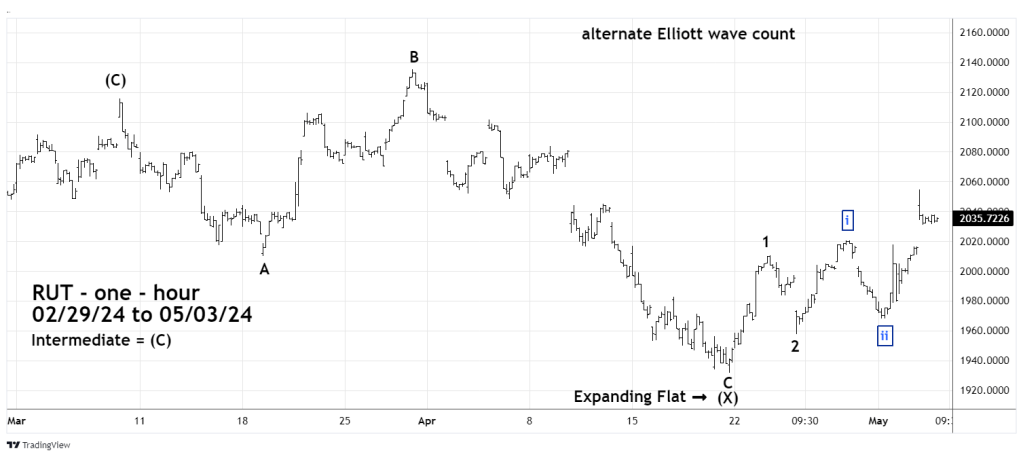

The next one – hour RUT chart shows an alternate bullish Elliott wave count.

The 04/24/24 blog “Russell 2000 – Clear Elliott Wave Pattern” noted.

“ The RUT decline from 03/28/24 to 04/19/24 was an extended Elliott Impulse wave. “

Elliott wave Expanding Flat corrections that are composed of three sub waves, which further subdivide into, three waves down – three waves up and end in five waves down.

In the alternate wave count the Expanding Flat correction begins at the 03/08/24 peak. The mid-point is the marginal new high made on 03/28/24 labeled Minor wave “B”. The final segment – Minor wave “C” subdivides into five waves, in this case an extended Impulse.

The rally after the 04/19/24 bottom could be a series of “one’s” and “two’s” up. In this scenario a powerful third of a third wave up is developing that could blast above the presumed Fibonacci .618 resistance level. If this were to occur the RUT could move up to at least its 03/28/24 top.

Traders are 100% short Russell 2000 non – leveraged funds from the 04/01/24 open.

Lower half the stop loss to a move above RUT 2,105.00 which is just beyond the 04/04/24 peak.

Lower the other half of the stop loss to a move above RUT 2,070.00.