On 01/11/24 – Bitcoin in U.S. dollars (BTCUSD) reached important Fibonacci resistance and then rapidly declined. Several factors indicate this could just be the start of at least a multi-month bear phase.

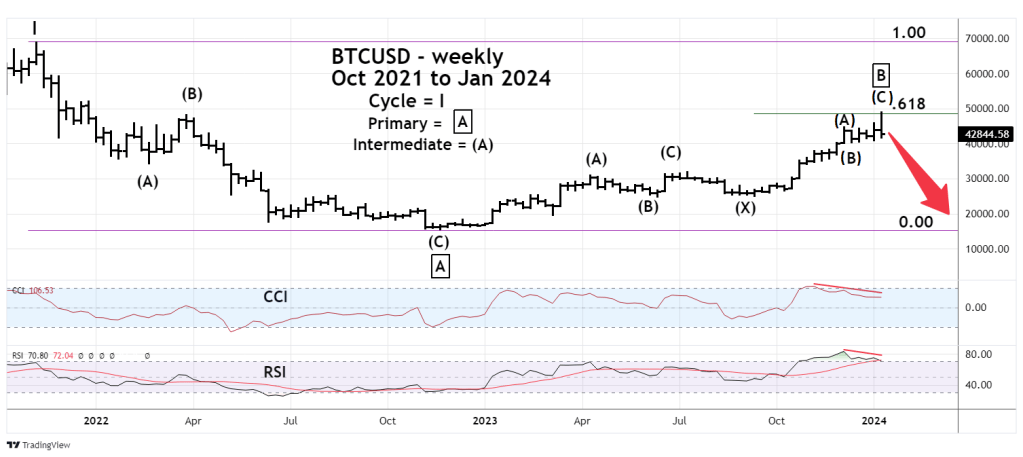

The weekly BTCUSD chart courtesy of Trading View illustrates the big picture.

The BTCUSD all-time high was in November 2021 it then fell 77% bottoming in November 2022.

The subsequent almost fourteen-month bull market peaked just above a Fibonacci .618 retracement of the prior bear phase. The exact .618 retracement level is 48,553. The actual high was 48,965 or a .625 retracement, within the leeway zone of .618.

On 01/10/24 the U.S. Securities and Exchange Commission (SEC) approved eleven Bitcoin – Exchange Traded Funds (ETF). This could be a classic example of buying on the rumor selling on the news.

At the BTCUSD top, weekly CCI had a significant bearish divergence. RSI had a double bearish divergence and was still in the overbought zone!

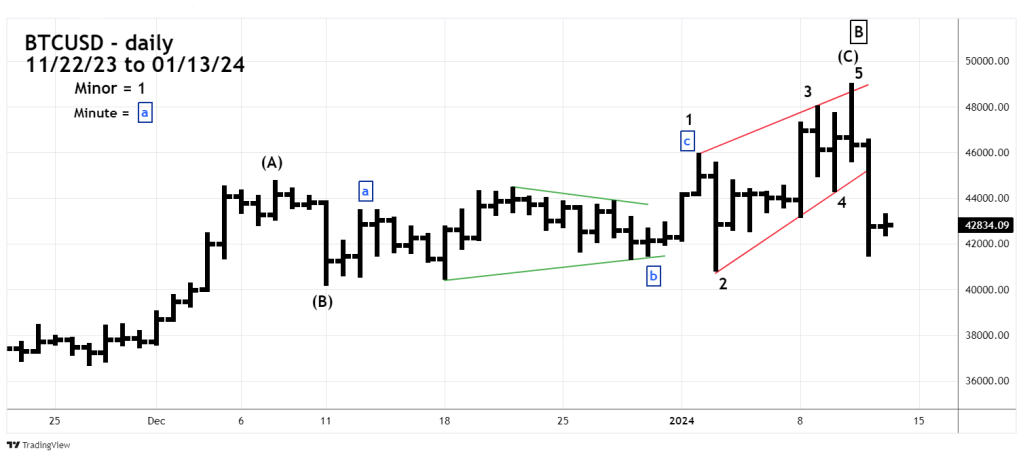

The daily BTCUSD chart zooms in on the short- term Elliott wave count.

The rally from the 12/11/23 bottom, labeled Intermediate (B) counts best as an Elliott wave – Ending Diagonal Triangle (EDT). They appear at the termination points of larger patterns in either the fifth wave position of motive patterns or in the “C” wave position of corrective patterns.

Each of the five sub waves themselves divide into three sub- waves.

There’s frequently a throwover of the trendline connecting the termination points of waves “one” and “three”. Which in this case did occur. Typically, after completion of an EDT there’s a rapid retracement. So far in just two trading days BTCUSD has declined more than 12%.

If BTCUSD has made a Primary degree peak, the subsequent bear market could continue for several months retracing back to at least the November 2022 major bottom.

The presumed BTCUSD turn could also have a connection to the U.S. stock market. The BTCUSD all-time high was on 11/10/21. The S&P 500 (SPX) all-time high was 01/04/22. If the same phenomenon repeats in 2024 the SPX could make its final post October 2022 rally high on or near 03/05/24.