At the close of trading on 10/13/23 it appeared that Crude Oil (CL2!) had completed a post-crash bounce. During the week of 10/16/23 to 10/20/23 – CL2! – made additional upside progress. The move up from the 10/06/23 bottom still appears to be a bear market rally which could be complete.

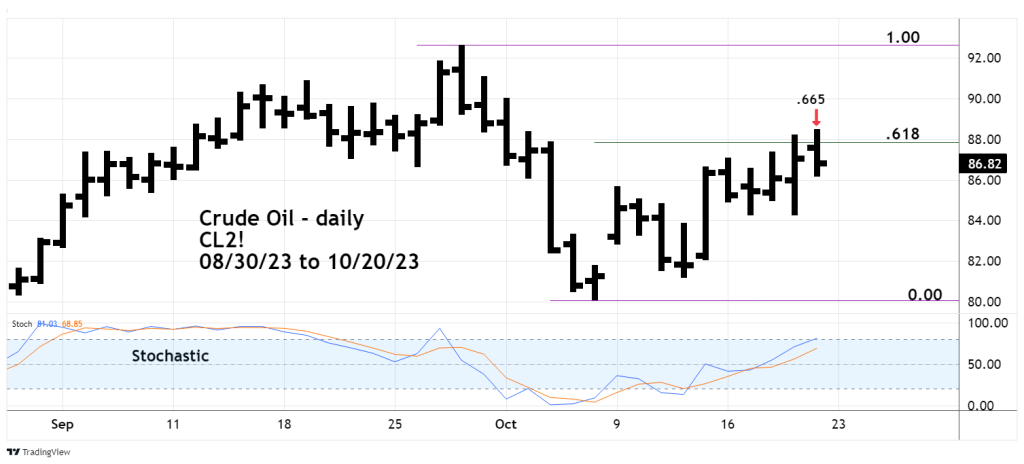

The daily CL2! – chart courtesy of Trading View updates the action.

The Golden Fibonacci ratio is .618 or 34/55. Nearby is what’s referred to as an outlier Fibonacci ratio of .666 or 2/3. On 10/20/23 – CL2! – reached a .665 retracement of its 13% – 9/27/23 to 10/06/23 crash.

The upper line of daily Stochastic has reached the edge of the overbought zone at 80%.

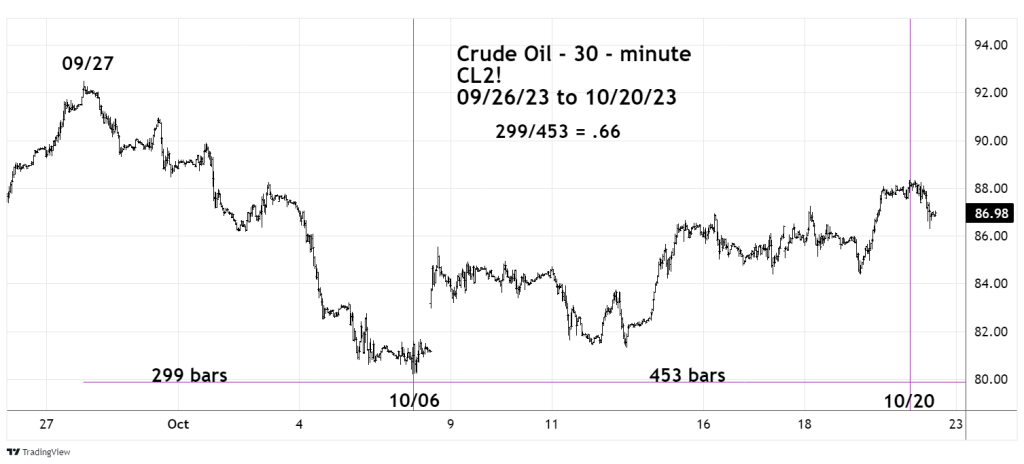

The 30 – minute CL2! – chart illustrates a Fibonacci time ratio.

The decline from 09/27/23 to 10/06/23 was 299 – 30 – minute bars. The rally from 10/06/23 to 10/20/23 was 453 – 30 – minute bars. The outlier Fibonacci ratio of 299/453 or .66, amazing!

The one – hour chart examines the Elliott wave structure of the of the 10/06/23 to 10/20/23 rally.

The pattern appears to be a Double Zigzag correction. The double bearish RSI divergence supports the theory that the upside pattern could be complete.

Seasonal patterns for Crude Oil are bearish until late December.

Fibonacci price/time ratios combined with bearish momentum imply the next down wave may have begun on 10/20/23.

The 10/14/23 blog “Crude Oil Shorting Opportunity – 10/13/23” recommended traders to take a 50% position in the Ultrashort Bloomberg Crude Oil fund – symbol (SCO). Time of the trade was at the open of the main U.S. stock market on 10/16/23. The opening SCO price on 10/16/23 was 17.01. The stop loss for half of the position at 16.20 was hit on 10/19/23. The percentage move up was 4.8%, the percentage loss for half the position was 2.4%.

Continue holding the remaining half of the position with a stop loss at 15.80.

CL2! – ended the 10/20/23 trading session at 86.98. If the next down wave has begun the minimal target is the 10/06/23 bottom near 80.00. Considering the bearish season could continue for two months, its more likely CL2! – could reach 75.00.

If a low-risk entry point develops, there could be an opportunity to add to the SCO position.