This is a follow up to the prior blog “Stock Market Fuel” and illustrates two paths the Dow Jones Industrial Average (DJI) could take in the coming months. The projections assume that the DJI has been developing an Elliott wave – Horizontal Triangle from its all-time high in January 2022.

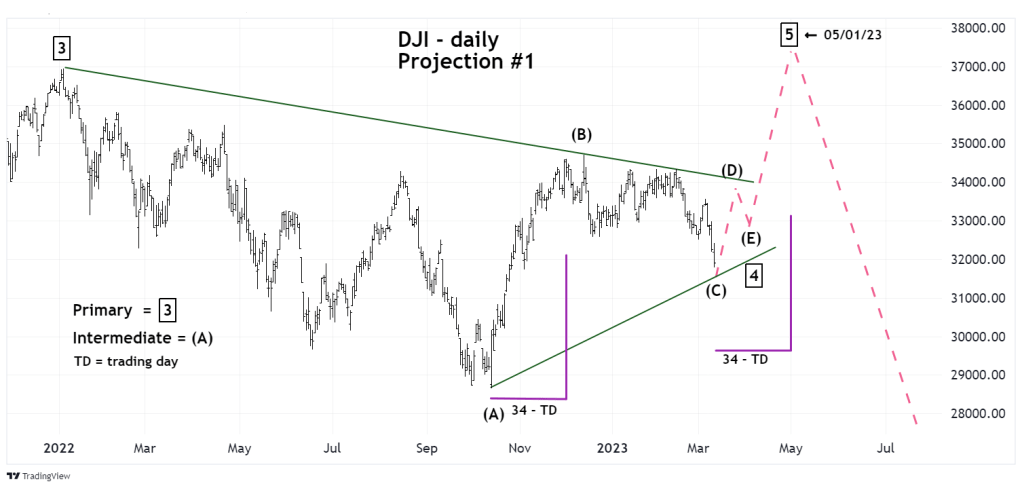

The daily DJI chart courtesy of Trading View shows the first projection.

Sometimes in Horizontal Triangles waves “D” and “E” have much smaller proportions than the prior waves “A”, “B”, and “C”. They may also not touch the triangle trendlines.

This projection assumes a bottom is made on 03/13/23. Note that almost all of the DJI October to December rally was made from 10/13/22 to 12/01/22 which is 34 – trading days (TD). Adding 34 – TD to 03/13/23 targets 05/01/23 – in the stock seasonal topping zone late April/early May. Also note that the length of the DJI October to December rally added to an assumed bottom near 31,600 targets a new all-time high.

If the DJI fails to make a bottom 03/13/23 to 03/17/23, the probabilities of a new all-time high in early May 2023 decrease significantly.

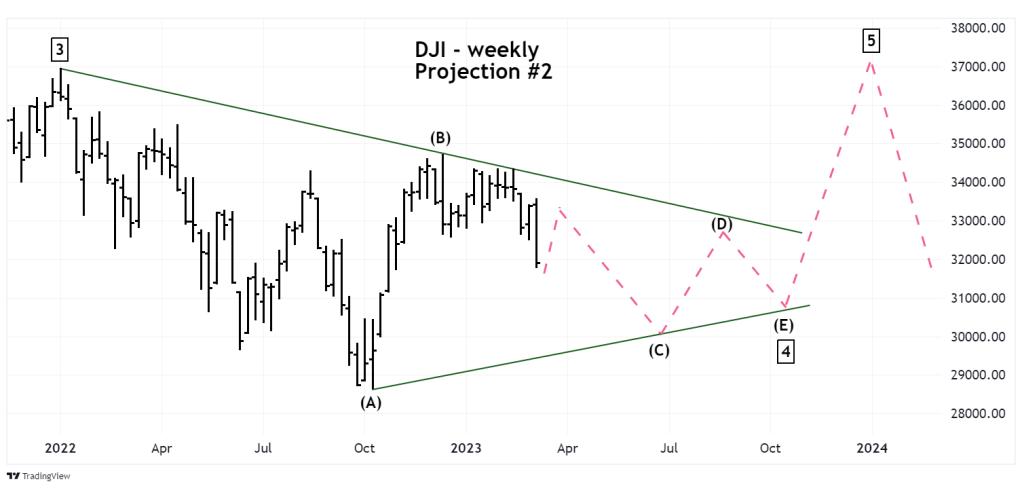

The weekly DJI chart illustrates the second projection.

This Horizontal Triangle sub waves are relatively proportionate to each other. This forecast assumes a bottom being made sometime between 03/13/23 to 03/17/23, followed by a failed rally. Then the assumed wave ( C ) decline resumes – possibly for several weeks.

There is a third possible projection in which the DJI is not forming a Horizontal Triangle. In that scenario the DJI is currently in a sharp decline that could soon break below the October 2022 bottom. If this were to occur the sharp decline could be in a few weeks or even a few days.

Be prepared for any contingency, U.S. stocks and perhaps the global stock market could be at an important crossroad.