The 10/06/25 blog “Lunar and Seasonal Time Cycles – October 2025” examined the Lunar cycle phenomenon of markets turning on Full or New Moons plus or minus two trading days. This cycle was effective on 10/11/07 – a New Moon and the peak of a five – year S&P 500 (SPX) bull market.

The 10/06/25 blog noted “There’s a Full Moon on 10/07/25, the time window for an SPX peak is from 10/07/25 to 10/09/25. If the SPX peaks in that zone and declines into next week, a 5 to 10% decline could be underway”.

The daily SPX chart courtesy of Trading View examines what happened in October 2007 and October 2025.

While the SPX has yet to decline into next week, we know that 10/09/25 was a peak.

Please note that the October 2025 peak occurred almost on the exact eighteen – year anniversary of the October 2007 top.

The internal momentum going onto 10/09/25 was extremely bearish.

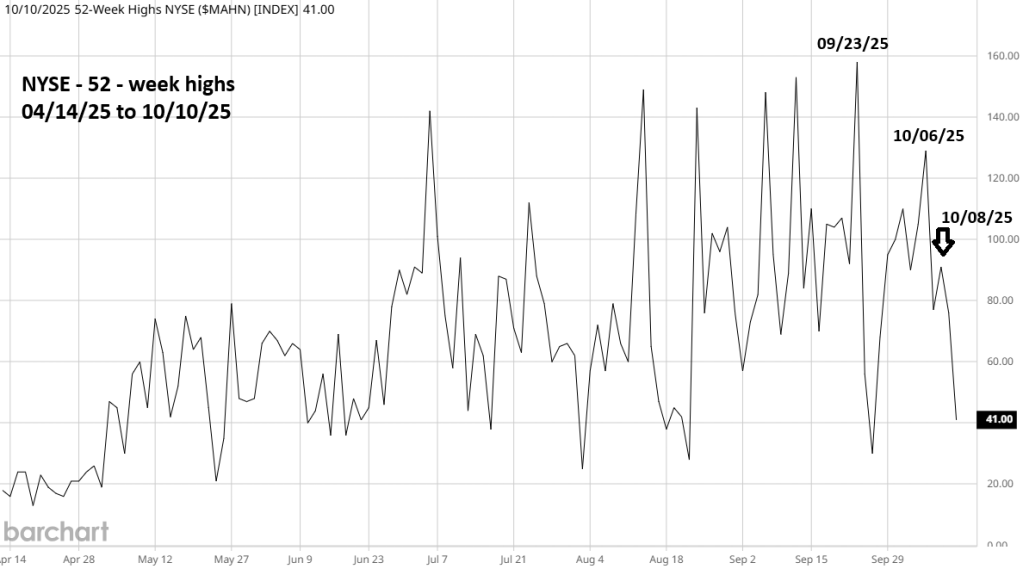

The daily NYSE – 52 – week highs chart courtesy of Barchart.com examines internal momentum since the April 2025 bottom.

Note that the new high gains after late June were marginal. Durning that same time the SPX climbed over 8% – this by itself is a bearish message. After the 09/23/25 post April momentum peak there was a double bearish divergence vs. the SPX rise. By 10/09/25 the bulls were exhausted.

Zooming out to a one year – 52 – week highs chart illustrates an even more bearish condition.

The 09/23/25 momentum peak was a double bearish divergence off the momentum peak in November 2024!

As stock bull markets progress, fewer stocks participate. At the ultimate peak there are typically only a few high-profile stocks making new highs.

Based just on internal momentum the SPX is ripe for at least a 10% decline from its 10/09/25 top.