On 09/17/25 the U.S. – FOMC lowered short – term interest rates by 25 – basis points. A few minutes after the announcement the U.S. 30 year – Treasury yield (TYX) bottomed out and began rising.

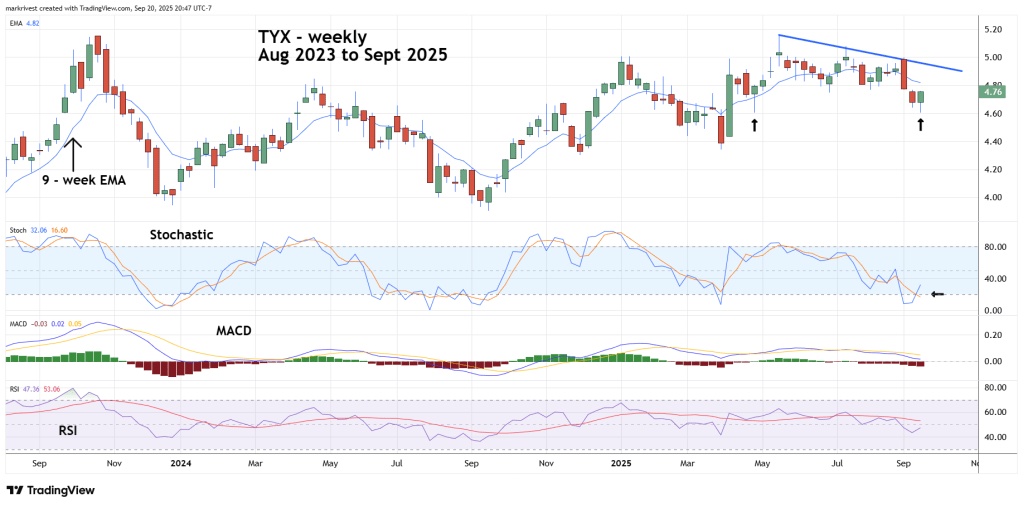

The weekly TYX chart courtesy of Trading View illustrates the long – term picture.

Since mid – 2023 -TYX has been in a choppy sideways channel. From April 2025 to September TYX has been in the upper part of the channel. Note the bottom made after the FOMC announcement is almost at the same level as the bottom made in late April 2025.

So far only the most sensitive oscillator – Stochastic has a bullish line cross. No bull signals from either weekly MACD or RSI and TYX is below its 9 – week Exponential Moving Average (EMA).

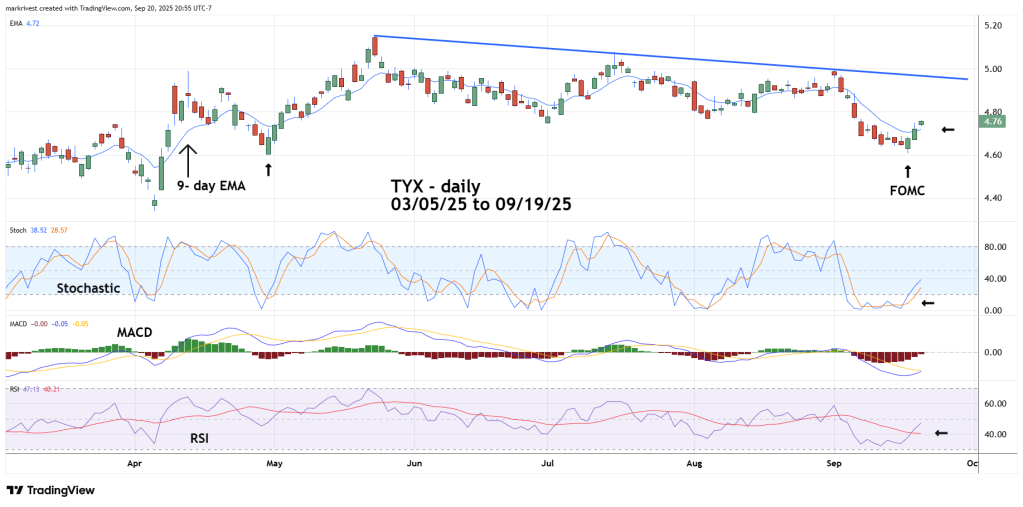

Now let’s zoom in on the daily TYX chart.

Daily RSI has crossed above its moving average line and MACD appears to be on the verge of a bullish line cross.

Most importantly TYX has closed above its 9 – day EMA. This strongly implies TYX could rally for at least one to two weeks.

The first upside target is the declining trendline from the 05/22/25 peak. If TYX can break decisively above the declining trendline, it opens the door for the important peak at 5.15. That 05/22/25 top corresponds to the multi-year TYX peak made on 10/23/23 at 5.15.

Triple tops a very rare, a decisive break above 5.15 could trigger a multi-month or even a multi-year TYX rally.

The FOMC can only control short-term rates, they have no control over long – term rates. A significant rise in long-term rates makes auto and housing loans more expensive. Reduced demand for autos and homes will probably have an adverse effect on the U.S. economy.

Currently the crowd is cheering the lowering of short-term interest rates and anticipating more rate cuts in the coming months. It’s doubtful the crowd will be cheering if longer-term rates continue to climb.