NYSE – 52 – week highs and the VIX give bearish signals for the U.S. stock market.

The VIX is very effective identifying S&P 500 (SPX) bottoms. VIX spikes up at or near the completion of an SPX decline. The situation is different when the SPX is reaching an important peak.

VIX signals a potential SPX peak when it reaches a higher low.

The 07/23/25 blog “Bullish VIX Signal – 07/23/25” illustrated that the VIX making a new post 04/07/25 low indicated the SPX could continue to make new highs, which it did.

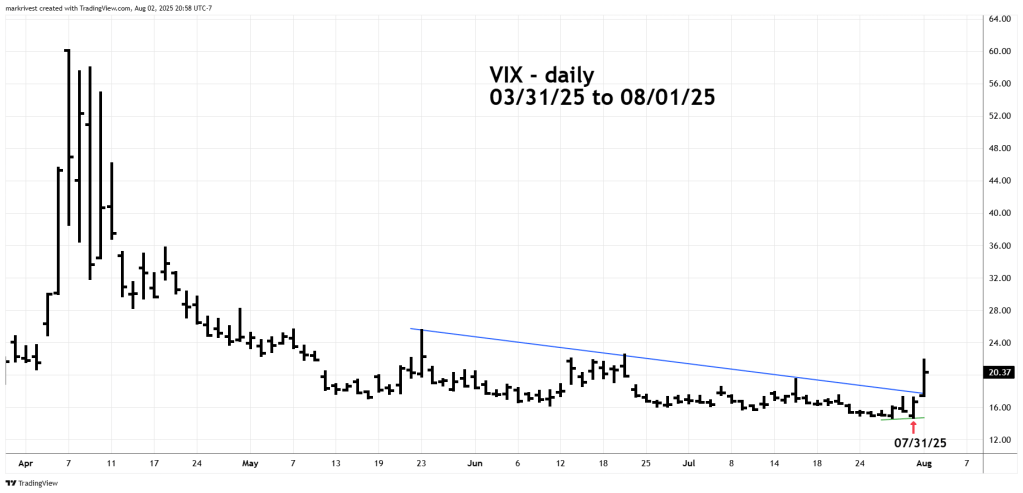

The daily VIX chart courtesy of Trading View updates its action.

At the SPX all-time high on 07/31/25 the VIX low was 14.74 above its low of 14.70 made at the SPX prior all -time high on 07/29/25.

Additionally, VIX has decisively moved above the declining trendline from the 05/23/25 spike up. This breakthrough implies an SPX multi-week decline may have begun.

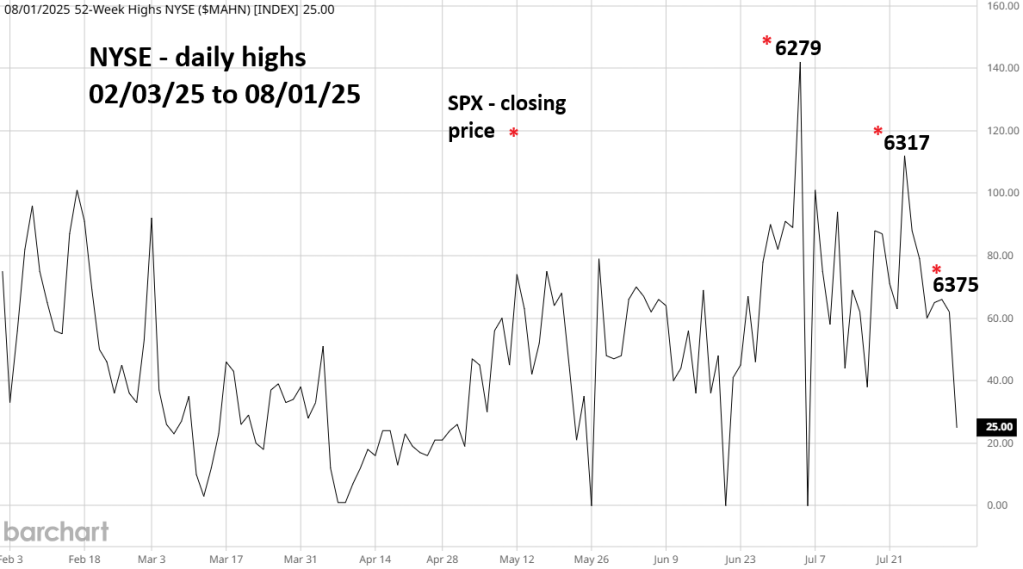

The daily NYSE – 52 – week high chart courtesy of Barchart.com illustrates internal momentum.

Since the SPX peak on 07/03/25 the number of new NYSE – 52 – week highs have been collapsing.

The highest SPX session close was on 07/28/25 at 6,375 occurred with a double bearish divergence of 52 – week highs.

The one – year daily NYSE chart puts this near – term bearish divergence in the proper context.

The decline of NYSE 52 – week highs since November 2024 when the SPX was at 5,929 is shocking!

A multi – week decline for U.S. stock may already have begun. We need to see what SPX does in the next one or two trading days. A move up to a marginal new all-time high could signal an important peak.

A break below SPX 6,201.00 could trigger a multi – week decline.

Also watch for an SPX move below 6,177.97. This is the SPX July 2025 low. A move below this level is a monthly Strat signal. If this happens a blog will explain the significance of the break.