The 07/18/25 blog “U.S. Stock Bulls on Thin Ice – 07/18/25” noted that the VIX made a higher daily low vs. the S&P 500 (SPX) new all-time high – a bearish factor. Also noted an additional bearish factor would be only one of the three main U.S. stock indices, SPX, Dow Jones Industrial Average, and Nasdaq Composite making a new all-time high.

On 07/23/25 SPX made a new all time high unconfirmed by the Dow Jones Industrial Average and the Nasdaq Composite.

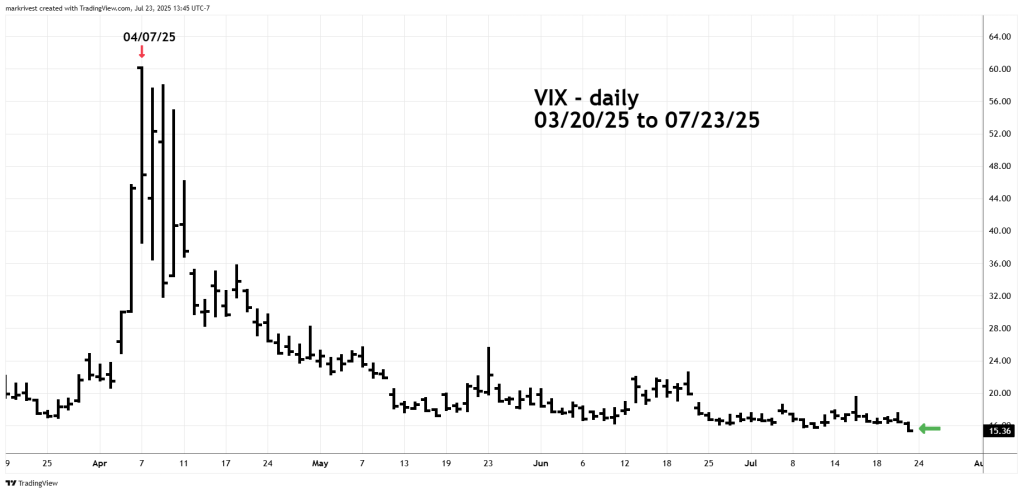

However, the VIX made a new post 04/07/25 low.

The daily VIX chart courtesy of Trading View illustrates its action.

VIX new low with the SPX new high is bullish and implies the U.S. post 04/07/25 rally continues.

The ideal setup for a major U.S stock market peak: VIX higher daily low with only one of the three main U.S. stock indices at a new daily all time high.