The prior blog “Tesla Downside Action” examined the weakest Magnificent Seven Stock – Tesla Inc. The focus now shifts to the strongest Magnificent Seven stock – Microsoft Corporation (MSFT), which so far is the only one of the seven stocks to make a new all-time high.

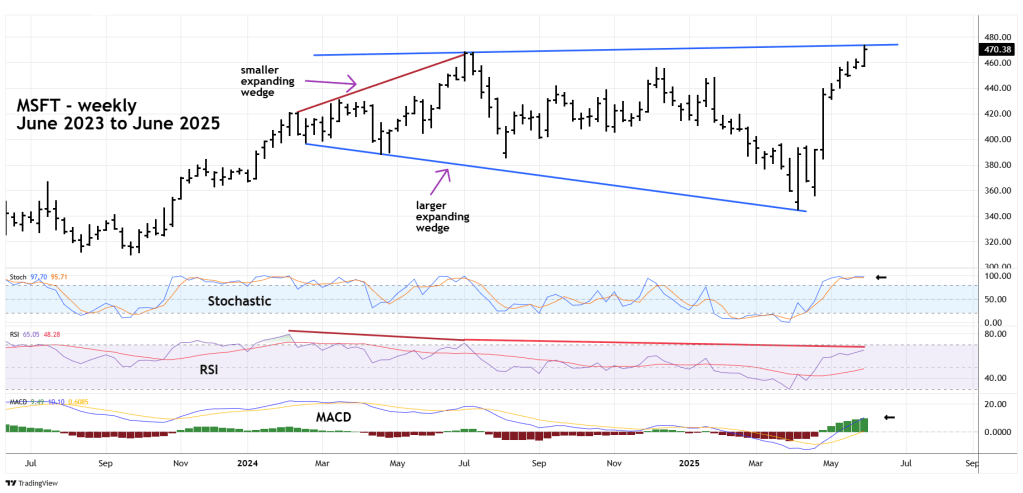

The weekly MSFT chart courtesy of Trading View illustrates its long-term action.

The STRAT method uses expanding wedges to identify potential turn areas. Note the smaller expanding wedge into the July 2024 peak. The trendlines give an indication of a possible turn. Subsequent bar action is required to get a buy or sell signal. In this case a STRAT sell signal came two weekly bars after the MSFT July peak.

The current MSFT all-time high has additional evidence because it is only marginally above the July 2024 peak. In the STRAT method this indicates potential exhaustion. At least two weekly bars would be needed to get a long-term sell signal like the July 2024 downturn.

Weekly Stochastic has flattened out in the overbought zone, however this flattening could continue for several weeks before a downturn occurs.

Weekly RSI has a double bearish divergence.

MACD lines and Histogram are still rising implying more upside action.

The weight of evidence from the weekly momentum oscillators indicate MSFT could continue to rally.

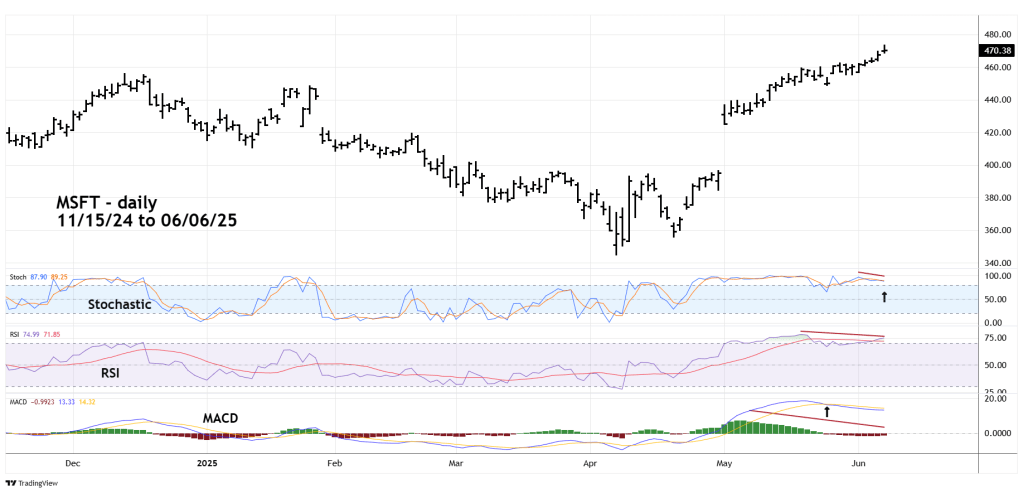

The daily MSFT chart examines the shorter-term action.

Daily Stochastic has a bearish divergence and a bearish line cross in the overbought zone.

Daily RSI has a bearish divergence in the overbought zone.

Daily MACD has a bearish line cross. Histogram and lines have bearish divergences.

The weight of evidence from the daily momentum oscillators implies at least a short-term decline could come soon.

MSFT is currently one of the strongest upside stocks in the U.S. market. A downside move in this stock could be a very bearish signal for the main U.S. stock indices.

The STRAT method could give a significant MSFT bear signal. The focus is on the weekly chart. The soonest an MSFT – STRAT bear signal could occur is during the week of June 16 to June 20.

Subsequent blogs on this website will update the MSFT situation.

Watch MSFT!