The 06/01/25 blog “Could One Stock Signal a U.S. Bear Market?” noted that Tesla Inc. (TSLA) had generated amazing signals in the prior two trading days.

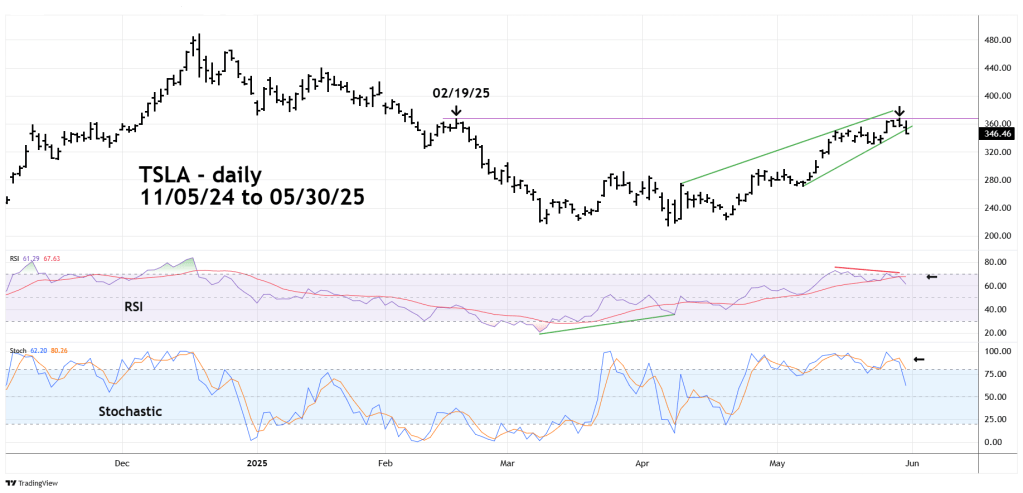

The following daily chart courtesy of Trading View is a reprint of the TSLA chart illustrated in the 06//01/25 blog.

The blog concluded with this forecast.

“In the coming weeks TSLA could decline 25 to 30%”.

Zero fundamental analysis was used to develop this forecast.

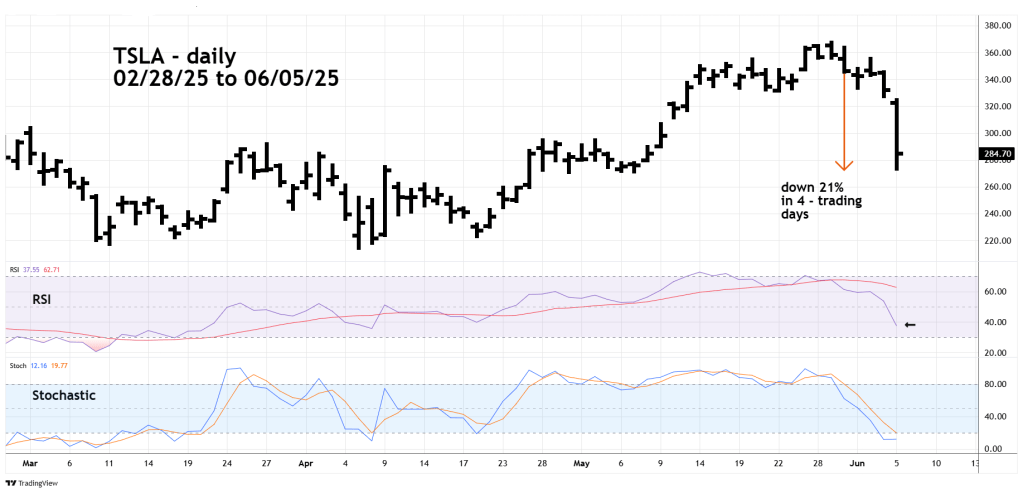

The next daily chart shows what’s happened to TSLA.

At the end of the main U.S. stock session on 06/05/25 TSLA – daily RSI was only at 37.00 the oversold zone begins at 30.00. There’s a high probability TSLA could soon go much lower.

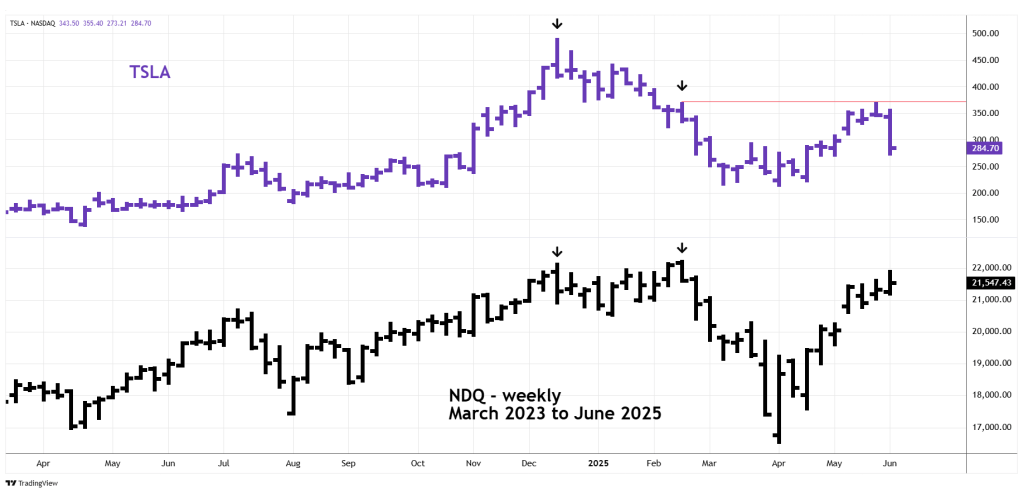

The weekly TSLA and Nasdaq 100 (NDQ) chart examines their long-term relationship.

TSLA is one of the ‘Magnificent Seven” stocks that have been a major factor of the U.S. stock bull market since October 2022. TSLA peaked before the NDQ all-time high made in early 2025. The TSLA decline after its December 2024 peak was a bearish warning for the NDQ.

What about the performance of all Magnificent Seven stocks relative to NDQ?

On 06/05/25 NDQ made a new post 04/07/25 rally high and retraced 94% of its February 2025 to April 2025 drop.

The following are the retracement levels of the Magnificent seven stocks since their respective all-time highs.

Microsoft (MSFT) on 06/05/25 made a new all – time by going 1.30 points above its 07/05/24 peak.

Nvidia (NVDA) post April rally has retraced 86% of its bear move

Meta Inc. (META) rally has retraced 82% of its bear move.

Amazon (AMZN) rally has retraced 65% of its bear move.

Tesla Inc. (TSLA) rallied to its 05/29/25 peak and had retraced 55% of its prior bear move.

Alphabet Inc. (GOOGL) has retraced 54% of its bear move.

Apple Inc. (APPL) has retraced 49% of its bear move.

Only one of the seven stocks has been able to outperform the NDQ. Amazing!

TSLA is now the downside leader. The other Magnificent Seven stocks and the broader U.S. Stock market could soon follow.