The 04/19/25 blog “Near-Term Gold Opportunity – 04/17/25” Ilustrated a strategy to potentially profit from a near – term drop in Gold. The conditions for Silver are the same, the profit opportunity could be greater.

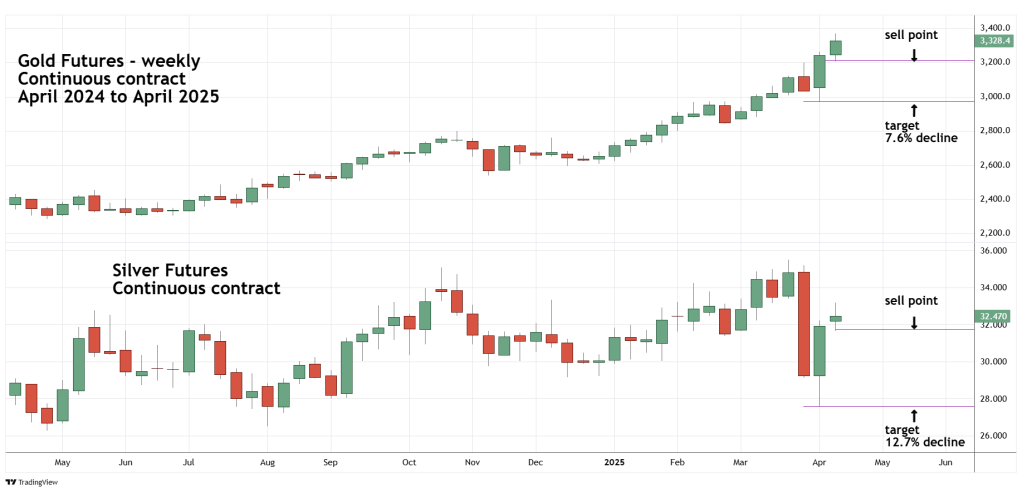

The weekly Gold Futures (GC1!) and weekly Silver Futures (SI1!) chart courtesy of Trading View illustrates their relationship.

On the long and short -term Silver has underperformed Gold on the upside and overperformed Gold on the downside.

The 04/19/25 blog explained a STRAT method to short Gold. The STRAT configuration points for Silver are different from Gold. The selling or short selling entry levels are the same, The downside target levels are also the same. For both Gold and Silver, the selling point is just below the week of 04/14/25 to 04/17/25 bottoms. The downside target level for both is the week of 04/07/25 to 04/11/25 bottoms.

The potential profit from a Gold short is 7.6%.

The potential profit from a Silver short is 12.7%.

Assuming a short sale is made the exit level for a stop loss is just above the week of 04/14/25 to 04/17/25 highs.

For Gold the risk is 5.1%, the reward to risk ratio is 7.6/5.1 or 1.5.

For Silver the risk is 4.5%, the reward to risk ratio is 12.7/4.5 or 2.8.

Even if you have no interest in Gold or Silver, please watch what happens to both in the next few weeks. The concepts of the STRAT method can be used on any market or stock on any time scale.