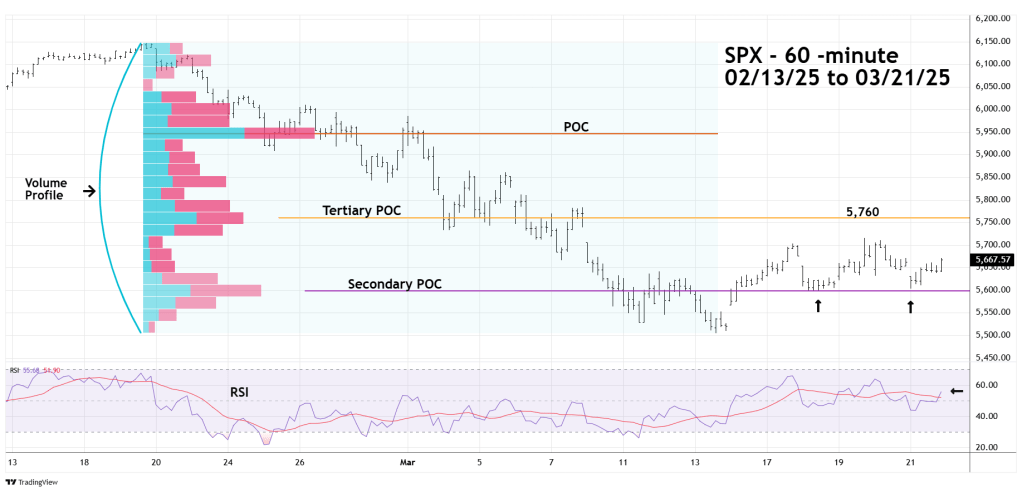

Volume Profile places volume on a vertical axis, it displays the distribution of trading volume across different price levels over a specified period. This helps traders identify areas of high and low trading activity and potential support/resistance levels.

The 60 – minute S&P 500 (SPX) chart courtesy of Trading View illustrates recent Volume profile action.

The widest part of a Volume Profile is called Point of Control (POC) it represents the strongest potential support/resistance. As the SPX declined to its recent low, a secondary POC formed. Note that after the SPX broke above the secondary POC the prior resistance became support. If SPX were to again break below the secondary POC it could signal the start of a significant decline.

If SPX rallies it could find resistance at the tertiary POC which is close to the SPX 200 – day Simple Moving Average and the Fibonacci .382 retracement of the SPX – 02/19/25 to 03/13/25 decline.

An SPX move above the tertiary POC near 5,760 could open the door for a move to the primary POC near 5,950.

Please note that the 60 – minute RSI is currently in the neutral zone at 55.68. If the 60 – minute RSI reaches the overbought zone above 70.00 it could signal an important peak.

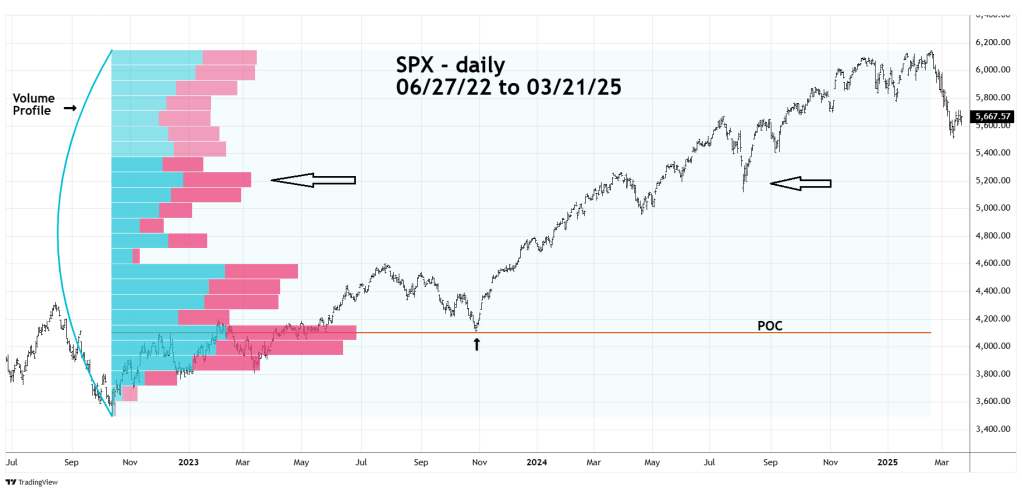

The daily SPX chart examines the longer-term Volume Profile.

Note that the next significant downside Volume Profile cluster is around the August 2024 mini crash bottom. Prior blogs on this website have illustrated this zone as a potential intermediate bottom.

If the SPX breaks below the August 2024 low, it could reach the major bottom made in October 2023. Note the primary daily POC is at this bottom.

If the SPX continues to decline it could reach the October 2023 bottom sometime in the fourth quarter of 2025.