Trendline and Fibonacci time analysis indicate the S&P 500 (SPX) could make an intermediate bottom on or near 04/03/25.

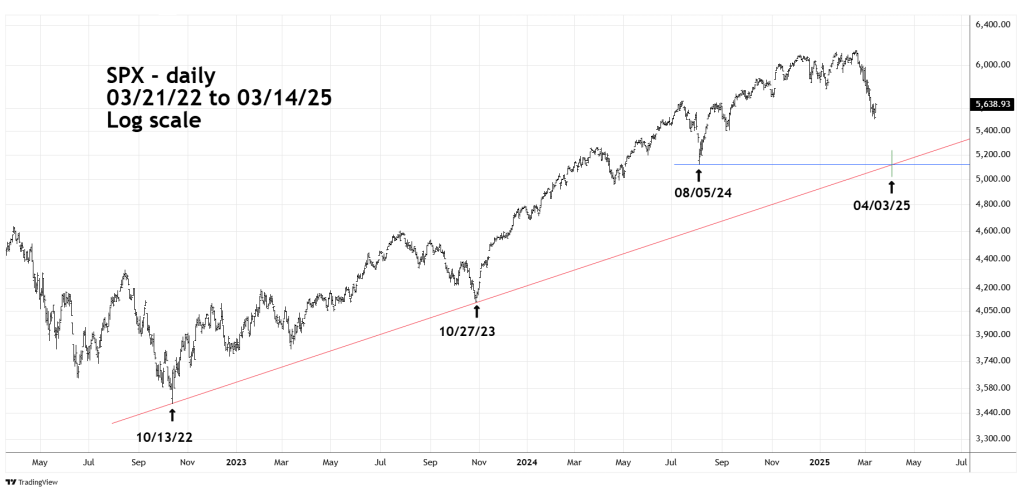

The first daily SPX chart courtesy of Trading View illustrates the long-term picture.

The two most significant bottoms of the October 2022 to February 2025 SPX bull market occurred in October 2023 and August 2024. Markets in decline tend to gravitate to the most significant support areas, which in this case is the August 2024 – mini crash bottom.

Using a Logarithmic scale chart a trendline drawn from the bull market point of origin on 10/13/22 to the bottom made on 10/27/23 intersects with the area of the 08/05/24 bottom on 04/03/25.

Please note that if the SPX decline after 02/19/25 continues at the same angle, it’s possible it could reach 5,200 to 5,100 on or near 04/03/25.

Also note that the angle of the drop since 02/19/25 is like the angle of the July to August 2024 mini crash.

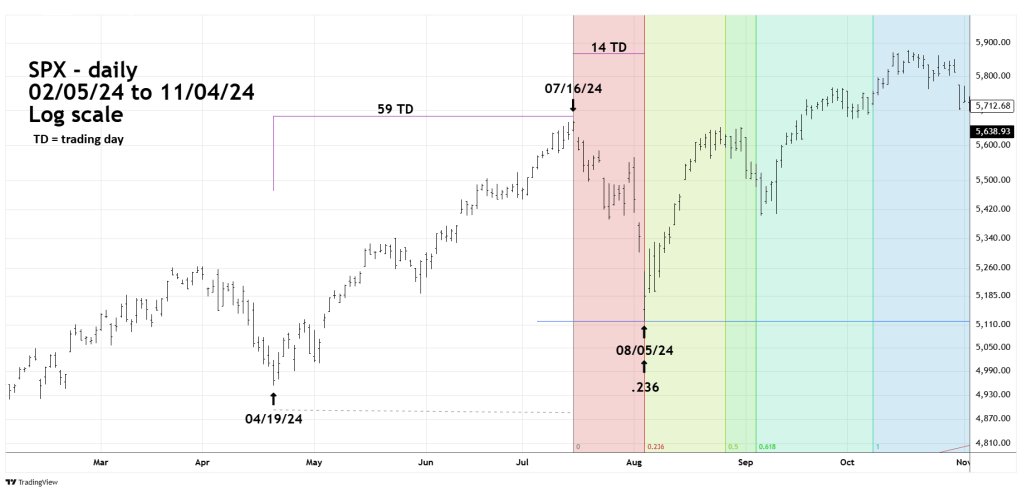

The second daily SPX chart focuses on the mini crash.

A major principle of Elliott Wave Theory is that trend movements are usually retraced in proportion to price and time.

For example, a price movement of 200 – points that lasted 60 – days could be retraced by 120 – points in 30 -days.

The SPX bull move from 04/19/24 to 07/16/24 lasted 59 trading days (TD). The subsequent decline was 14 TD. Dividing 14 by 59 yields the Fibonacci ratio of .236.

The third SPX daily chart examines the action after the 08/05/24 bottom.

The SPX bull move from 08/05/24 to 02/19/25 lasted 135 TD multiplied by the Fibonacci ratio of .236 equals 32 TD. A decline starting on 02/19/25, lasting 32 TD targets 04/04/25 as a potential bottom.

Anything can happen in the markets. We live in a world of probabilities not certainties.

Evidence from trendlines, Fibonacci time analysis and study of angles indicate the SPX could make a bottom on 04/03/25 or 04/04/25.