The theme for U.S. stocks in 2024 has been, main stock indices make new highs with bearish momentum. The indices have only minor declines, then the bearish momentum divergences are erased.

On 011/29/24 two of the main U.S. stock indices, S&P 500 (SPX) and Dow Jones Industrial Average made new all – time highs with bearish momentum divergences. Could this be the set up for another minor decline or the prelude to a bear market?

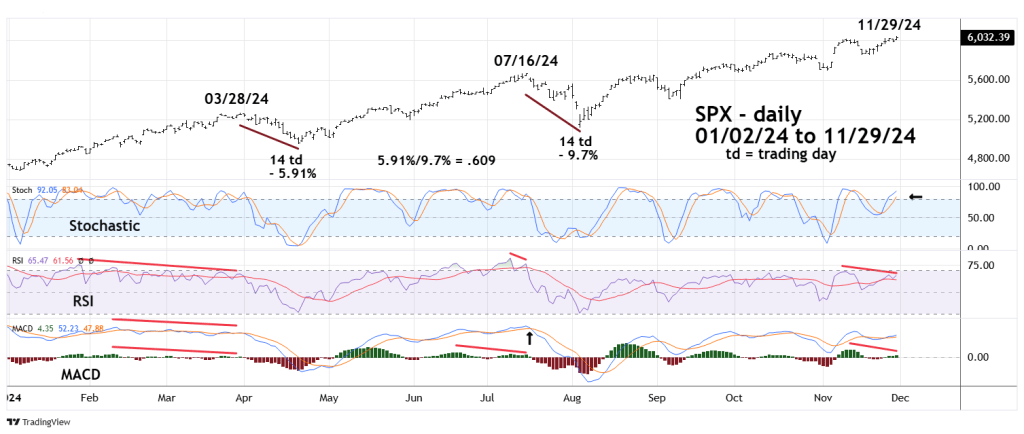

The daily SPX chart courtesy of Trading View updates its external momentum indicators.

Two minor declines occurred in 2024.

The drop after 03/28/24 lasted only 14 trading days falling just 5.91%.

The drop after 07/16/24 lasted 14 trading days and declined 9.7%.

The two declines are related by the Fibonacci equality time ratio 14 td to 14 td.

The Fibonacci price relationship is close to the golden ratio of .618. 5.91%/9.7% equals .609.

Prior to the March decline RSI had several bearish divergences. MACD lines and Histogram had bearish divergences.

Just before the July drop there was an RSI bearish divergence. MACD – Histogram had a bearish divergence MACD – lines had no divergence.

The readings on 11/29/24 illustrate a double RSI bearish divergence. MACD – Histogram has a bearish divergence, MACD – lines has a small bearish divergence however it could be eliminated if the rally continues. Both Stochastic lines have reached the overbought zone above 80.00. The lower line is only marginally above the boundary and implies more upside action.

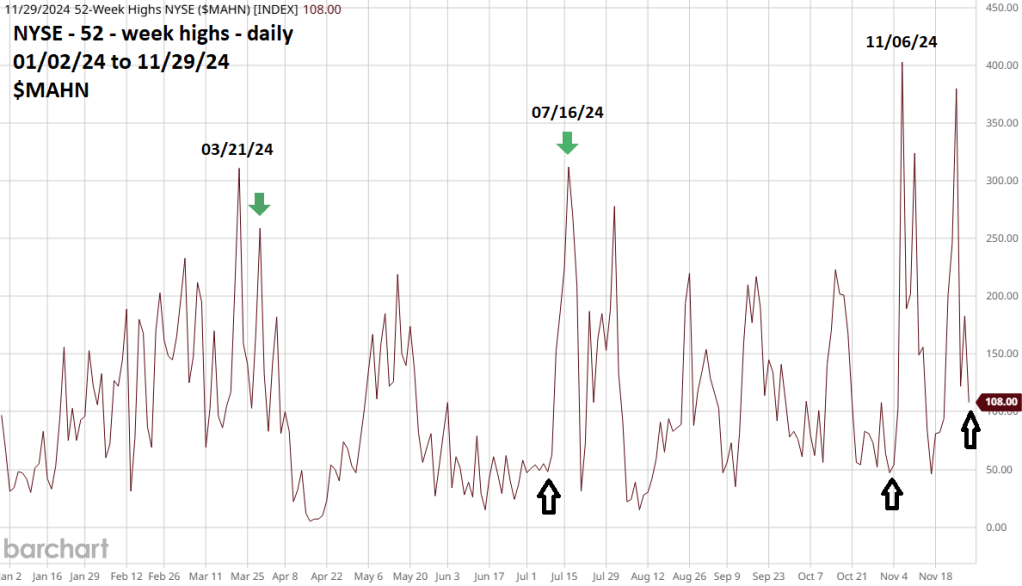

The daily NYSE 52 – week high chart courtesy of Barchart.com illustrates internal momentum.

Internal momentum peaked a week before the price high on 03/28/24.

July saw a rare occurrence of internal momentum hitting its maximum on the same day as the 07/16/24 price high.

Please note the momentum fake out that occurred on 07/09/24. On that day the SPX made a new high and it looked like a price drop was imminent. What happened was an upward surge.

Something similar happened on 11/01/24 although in his case the SPX was not making a new high.

The new all-high on 11/29/24 happened with 52 – week highs declining; another momentum fake out?

The Dow Jones industrial Average and the SPX making simultaneous new highs on 11/29/24 implies more upside action. Having only one of the three main U.S. stock indices make a new high is a stronger bearish signal.

The time dimension could provide a signal on the first trading day of December 12/02/24. Occasionally markets turn with the calendar, either yearly, quarterly, or monthly. Additionally, most if not all large stock fund managers were probably vacationing during the U.S. Thanksgiving holiday, 11/28/24 and partial trading day 11/29/24.

One other factor, sometimes markets turn on New/Full moons. There’s a New Moon on Sunday 12/01/24.