The U.S. November 05, 2024 election was historic and amazing. The reaction of several markets was also historic and amazing.

All three main U.S. stock indices made new all-time highs. Precious metals had huge movements down. Bitcoin had a huge move up. Long-term U.S. Treasury yields had huge up movements.

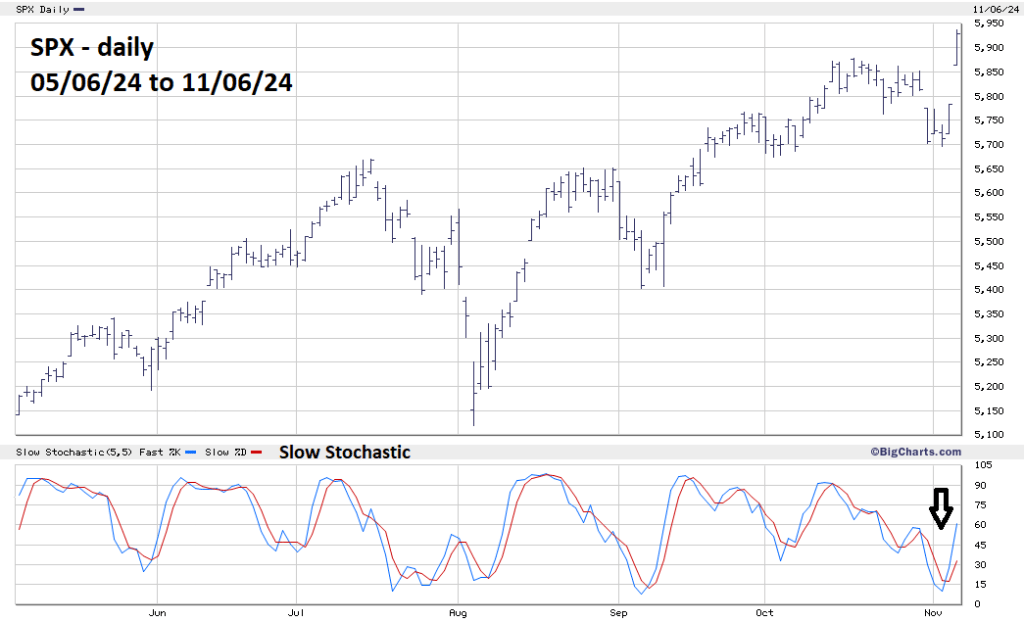

The daily S&P 500 (SPX) chart courtesy of BigCharts.com illustrates its action.

The very effective Slow Stochastic oscillator had a bullish lines cross and signals the uptrend could continue for at least several days.

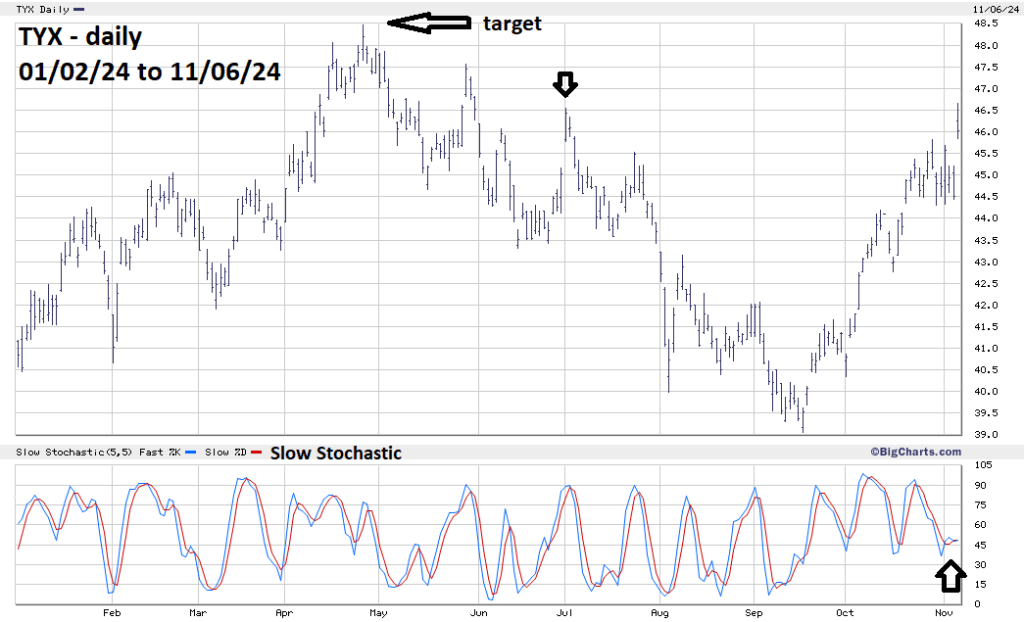

The next daily chart shows what happened with the CBOE 30- year Treasury Yields (TYX).

Surprisingly TYX had a big rally that exceeded 07/01/24 peak. This movement with the daily Slow Stochastic bullish lines cross implies TYX could soon reach important resistance at the 04/25/24 top.

Russell 2000 (RUT) also had a big increase which hit the stop loss level at 2,320.00 for the remaining half of a short position initiated at the open of trading on 09/23/24. The loss in the half position was 2.00%.

The next blog will compare the SPX reaction after the November 2024 election with its reaction after the November 2016 election.