Trendline and momentum indicators imply long-term rates are in a bull market.

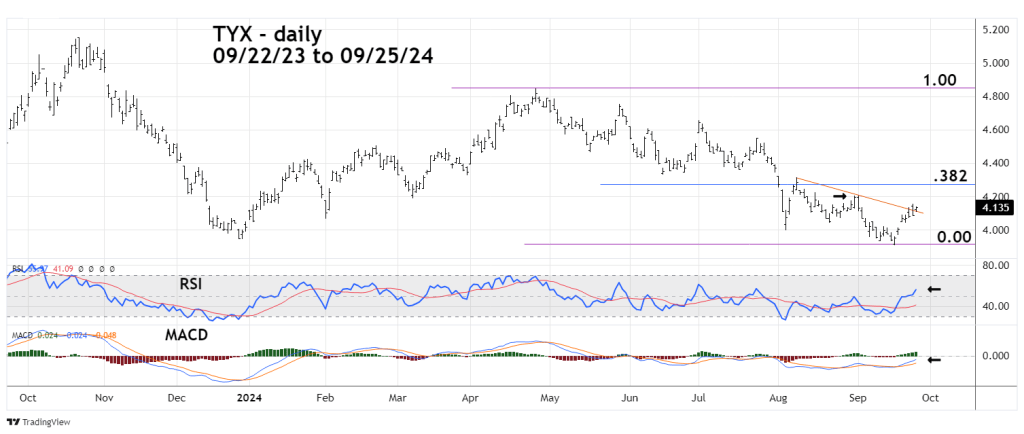

The daily CBOE 30- year Treasury Yield (TYX) courtesy of Trading View updates the action.

TYX has broken above the declining trendline connecting the 08/08/24 to 09/03/24 peaks.

Daily RSI is well below the overbought level which begins at 70.00.

MACD lines are below the “zero” level.

Next upside targets are the 09/03/24 peak at 4.206 and a Fibonacci .382 retrace of the April 2024 to September 2024 decline at 4.274.