The 09/01/24 blog “Dow Jones Industrial Average – Fibonacci Price and Time Relationships- August 2024” noted that the Dow Jones Industrial Average could decline after Labor Day. Immediately after Labor Day most U.S. stock indices began to fall. Momentum indicators imply this could be the beginning of a significant drop.

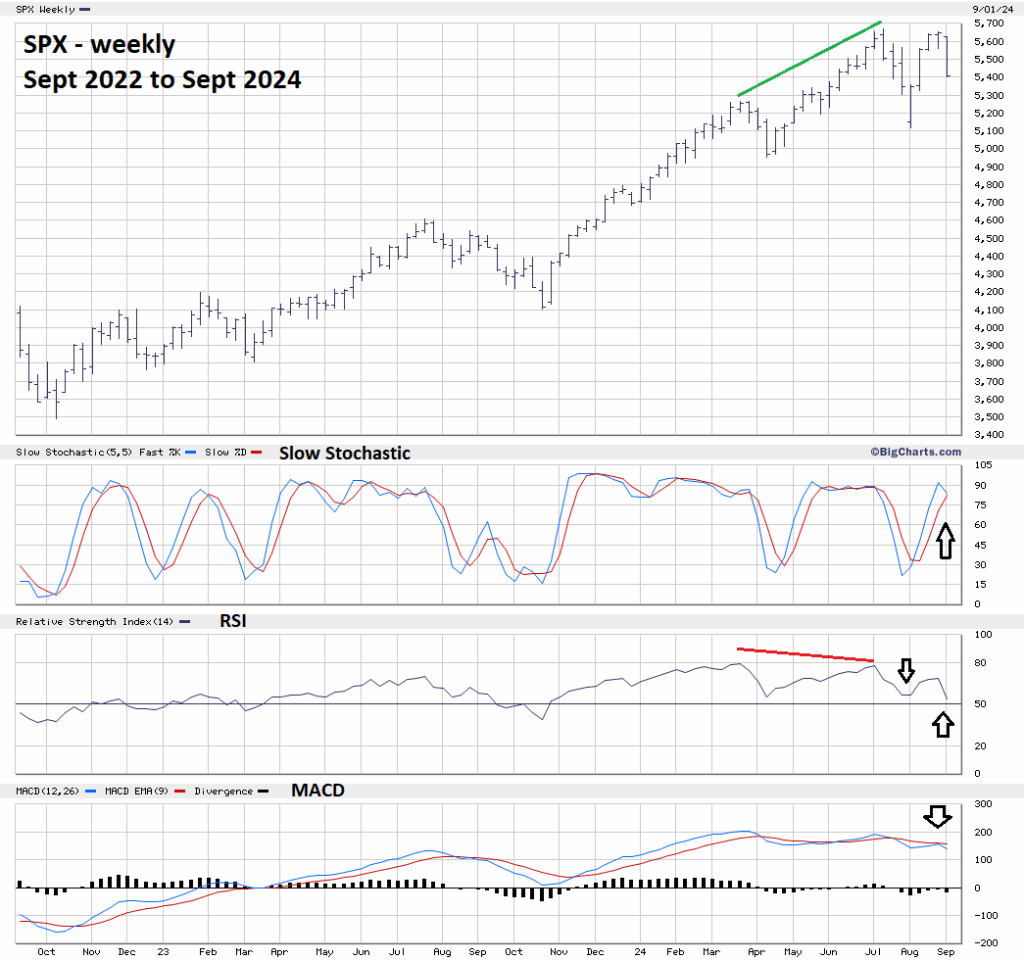

The weekly S&P 500 (SPX) chart courtesy of BigCharts.com illustrates long-term momentum.

Both lines of the Slow Stochastic are in the overbought zone which begins at 80.00. The lines are on the verge of a bearish cross.

Weekly RSI had a bearish divergence at the SPX July 2024 all-time high. In the first week of September 2024 – RSI went below the reading made in the first week of August 2024. Sometimes this can predict where prices could go. In this case it implies the SPX could go below the bottom made on 08/05/24.

The blue MACD line failed to cross above the slower moving red line and is declining. This recent action reenforces the bearish message of the MACD lines cross made in mid – July 2024.

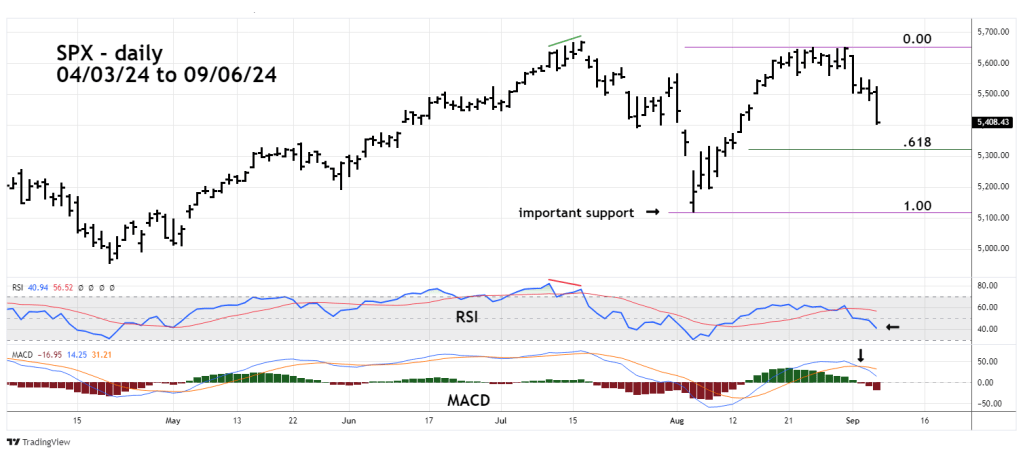

The daily SPX chart courtesy of Trading View zooms in on the short-term action.

Daily RSI is still in the neutral zone, the oversold zone begins at 30.00.

Daily MACD has a bearish lines cross. The prior daily MACD lines cross was in mid – July 2024 just before the mini crash.

Both long and short – term momentum oscillators suggest the SPX downside action could continue. The next support area to watch is the Fibonacci .618 retracement of the post 08/05/24 rally. A break below SPX 5,300 could open the door for a move down to the 08/05/24 bottom.

If the early August lows are broken the next support is the mid – April 2024 bottom.

There could be even more downside potential, especially if the bear phase continues into October 2024.

October is notorious for sharp and deep stock market declines.