The manic rally from the mini crash bottom made on 08/05/24 could terminate on 08/23/24.

The 08/11/24 blog “U.S. Stock Market Forecast – Late 2024” speculated that post 08/05/24 rally could be choppy and peak sometime in mid – September 2024. What’s happened so far has been a very sharp rally that could end in one or two trading days.

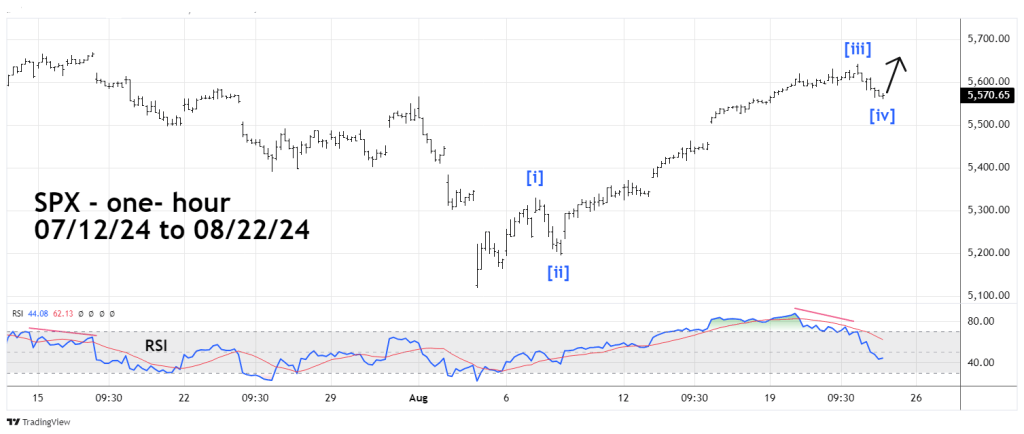

The one – hour S&P 500 (SPX) chart courtesy of Trading View updates the short – term Elliott wave count.

Recent blogs on this website have noted the SPX could soon have a fourth wave decline of the presumed developing five wave Impulse pattern from the 08/05/24 bottom.

It appears Minute wave [iv] may have bottomed at the SPX low on 08/22/24.

There’s usually a Fibonacci price relationship between waves “two” and “four’ of Impulse patterns.

The presumed Minute wave [ii] was 135.10 points multiplied by the Fibonacci ratio of .618 equals 83.50 points. The high of the presumed Minute wave [iii] was 5,643.22 minus 83.50 targets SPX 5,559.72. the low on 08/22/24 was 5,560.95.

Since November 2023 U.S. stocks have rallied on the belief that short-term interest rates could be cut sometime in 2024. The 08/11/24 blog speculated that the stock rally could end in mid-September 2024 on news that the U.S. – FOMC could cut interest rates at their 09/19/24 meeting. This scenario could still happen or perhaps the rally culminating news may happen on 08/23/24.

On 08/23/24 FOMC – chairman Jerome Powell speaks at the annual Jackson Hole symposium. Perhaps the Speech could trigger the Minute wave [v] final rally of the post 08/05/24 bull move.

There’s a very good chance this “news” could be the prelude to a decline.

How large of a decline? We may not know until 09/17/24.

A short-term rally above the 08/22/24 peak could end quickly.