Throughout the 2024 U.S. stock rally the Nasdaq Composite and its sub index Nasdaq 100 (NDX) were the upside leaders. Since their respective all-time highs things have been different.

The performance of the three main U.S. stock indices and NDX from their all-time highs to their recent decline bottoms are as follows.

Dow Jones Industrial Average – down 3.8%.

S&P 500 – down 5%.

Nasdaq Composite – down 8.8%.

Nasdaq 100 – down 9.6%.

The Nasdaq Composite and the Nasdaq 100 hold a high percentage of mania driven technology stocks fueling the U.S. 2024 stock rally. This new relative weakness could be a bearish omen for the remainder of 2024.

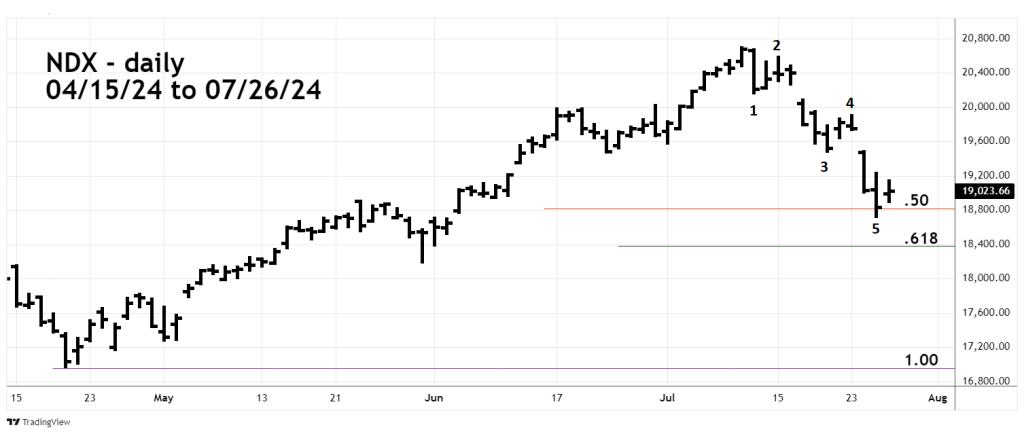

The daily NDX chart courtesy of Trading View illustrates its recent performance.

While the S&P 500 has recently moved marginally below a Fibonacci .382 retracement of its April to July rally. The NDX has retraced more than .50 of its April to July move up.

Also note the clear Elliott – five wave Impulse pattern. This structure could be the first wave of a larger developing bearish movement.

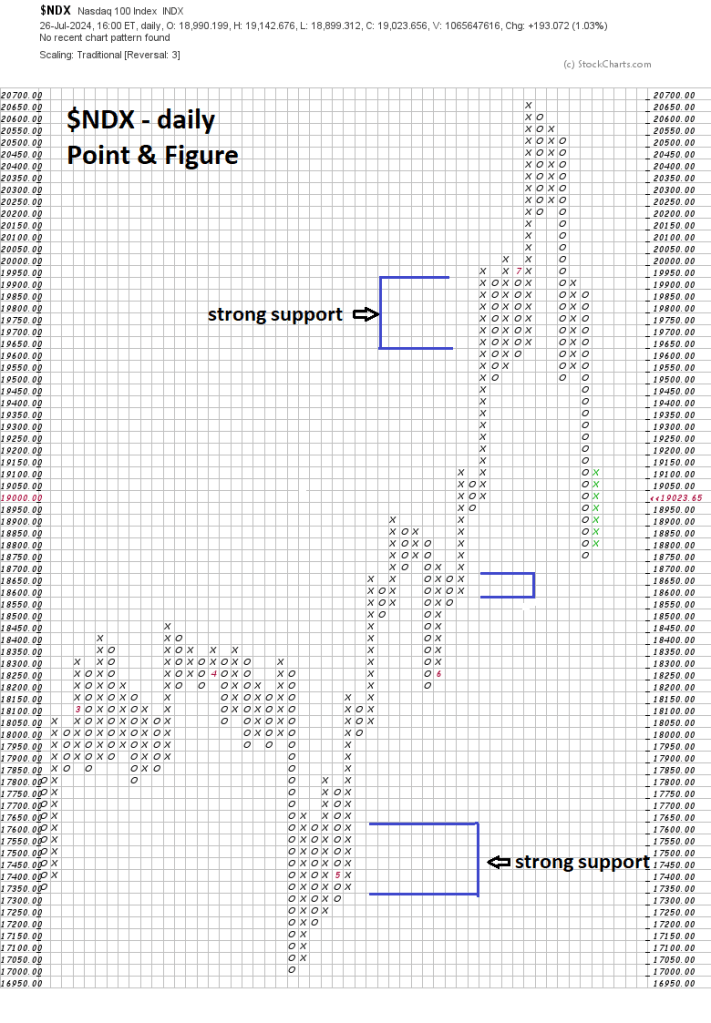

The NDX – Point & Figure chart is courtesy of StockCharts.com.

A Point-& Figure chart plots price movements without taking into consideration the passage of time. Rallies are illustrated as “X” declines as “O”

These charts are very effective in discovering support and resistance. The longer the row of X’s and O’s, the greater the strength of potential support/resistance.

The NDX recently pushed through several five column rows and has lesser support of four column rows below. If the NDX can break through this weaker support there’s a good chance of reaching at least 17,600.

This websites prior blog noted that its highly unlikely that big money funds are rotating into small cap stocks.

There could be rotation taking place. Except it’s probably big money funds rotating out of stocks and into cash.