The 07/08/24 blog “Major S&P 500 – Fibonacci Resistance” noted long – term resistance at 5,615.63. On 07/11/24 the S&P 500 (SPX) high was 5,642.45 within leeway of the bullseye target.

The weekly SPX chart courtesy of Trading View illustrates the long-term action.

The bullseye target of 5,615.63 was calculated by taking a Fibonacci .382 ratio of the SPX growth from 2009 to 2020 and adding this to the March 2020 bottom. There’s no exact formula to determine Fibonacci leeway zones. Using .390 targets SPX 5,687.30 as the upper leeway limit.

Weekly RSI is in the overbought zone which begins at 70.00, the most recent weekly reading is 76.85 diverging off the March 2024 reading of 78.98.

On the bullish side of the coin the SPX moved above the long-term trendline connecting the July 2023 and March 2024 peaks.

The daily SPX chart illustrates the shorter-term view.

Daily RSI on 07/10/24 hit 81.67 diverging off the 12/19/23 reading of 82.11.

The SPX hit a short-term rising trendline connecting the May and June 2024 peaks.

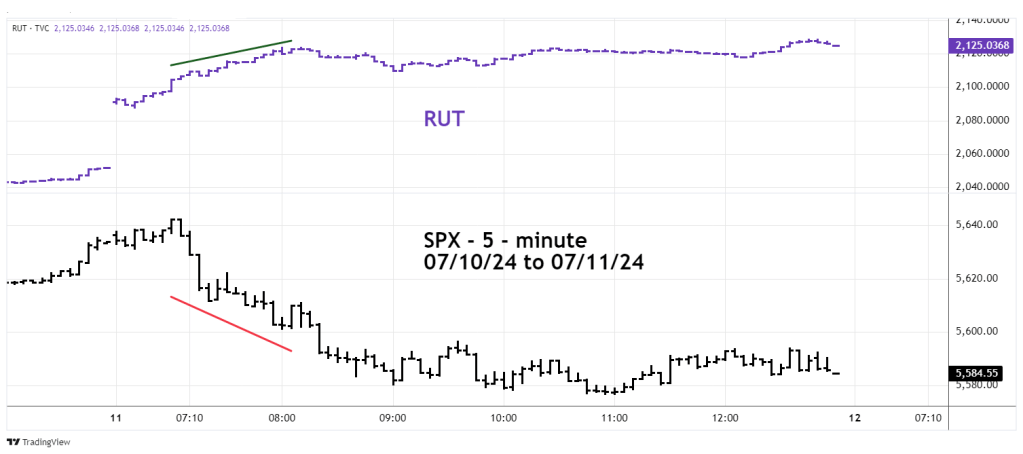

The 5 – minute SPX and Russell 2000 (RUT) chart shows the intraday relationship between the indices.

On 07/11/24 the RUT rallied 3.57% outperforming the SPX by a wide margin in a dramatic reversal of recent action.

The 07/06/24 blog illustrated that on 07/03/24 the RUT had a strong decline while the SPX had a sharp rally. On 07/11/24 it was a role reversal.

It’s too early to tell if this is a one-day surge or the start of a new RUT rally.

At the 07/11/24 close RUT was 13.5% below its November 2021 all-time high.

On 05/23/24 a 100% RUT short position was initiated with a stop loss for half the position on a move above RUT 2,115.00. The huge surge today triggered the stop level for a loss of 0.61%. Continue holding the other half of the position with a stop loss on a move above 2,140.00.