The Nasdaq Composite (IXIC) struggles to go down. On 04/12/24 the S&P 500, Dow Jones Industrial Average, and the Russell 2000 made new decline lows. The IXIC not only held above its 04/04/24 bottom, but it also failed to go below the bottom made on 04/10/24.

The 30-minute IXIC chart courtesy of Trading View illustrates what could be developing.

This site’s 04/11/24 blog illustrated the IXIC may have completed an Elliott wave – Horizontal Triangle as of the 04/10/24 bottom. The new alternate count has the Horizontal Triangle ending as of the 04/12/24.

The original Horizontal Triangle count could still be in effect. If so, the IXIC rally high made on 04/11/24 could be wave “one” of a still developing five wave motive pattern.

For either wave count, if a rally develops it likely could last for two to five trading days and exceed the IXIC top made on 03/21/24.

The actions of two important stocks support the theory of a short-term IXIC rise.

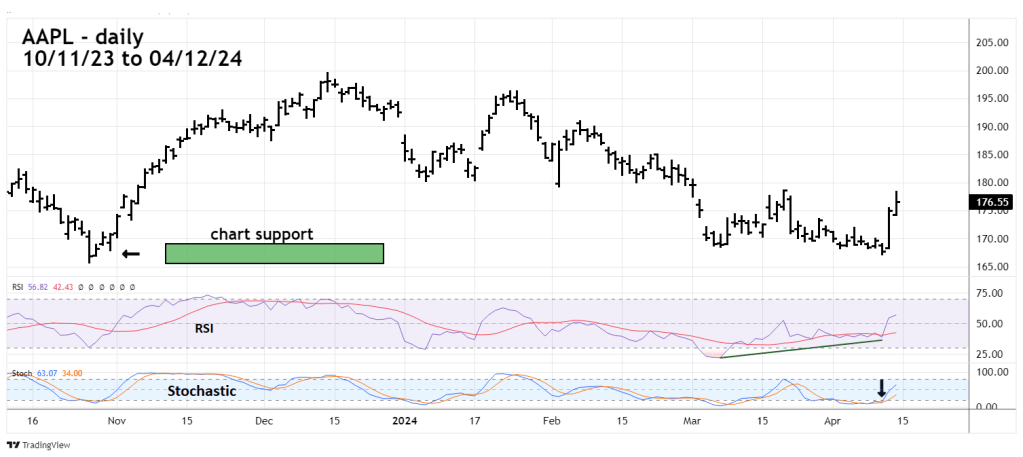

The daily chart of Apple Inc. (AAPL) updates its action.

The 03/03/24 blog “Apple Inc. Major Downside Break” examined the APPL break below 179.25 with the following commentary.

“Note that below 179.25 there’s minimal chart and volume support, this is sometimes referred to as “air”. There’s a good chance AAPL could quickly move through this “air” and reach the next significant price support. The October 2023 bottom.”

Subsequently AAPL did make it very close to the October 2023 bottom. At the recent low made on 04/10/24 there was a significant daily RSI bullish divergence, then on 04/11/24 a bullish Stochastic line cross. On 04/12/24 with most of the U.S stock market declining AAPL went up.

There’s a good chance AAPL could rally for at least a week. AAPL fell more than 30% in its December 2023 to April drop. During that time, it significantly underperformed the U.S. stock market . This very weak relative performance is a bearish warning for AAPL. If AAPL does have a near-term rally, it could be just a bounce in a larger developing bear phase.

The daily chart of Nvidia Corporation (NVDA) shows its recent performance.

NVDA’ s spectacular 800% gain since its bottom in October 2022 makes it the king of all U.S. stocks. And the king continues to show its strength. NVDA made a small correction bottom on 03/11/24 at 841.67. It took NVDA nearly a month to make a lower bottom at 830..21 on 04/09/24. The shallow drop implies NVDA could soon make a new all-time high.

The 03/16/24 blog “Nvidia – Long – Term Elliott Wave Count” noted NVDA could peak at 1,157.70. There’s also potential round number resistance at 1,000. Mania stocks like NVDA are drawn to round numbers and 1,000 is a very tempting target.

Daily Stochastic has a bullish line cross. So far RSI is still below its moving average line.

Short – term evidence implies IXIC could rally during the week of 04/15/24 to 04/19/24.

An IXIC move below its 04/04/24 bottom before moving to a new all-time high would invalidate the Horizontal Triangle count. If this scenario occurs it could open the door for significantly lower IXIC prices.