On 03/28/24 of the three main U.S. stock indices only the S&P 500 (SPX) made a new all-time high.

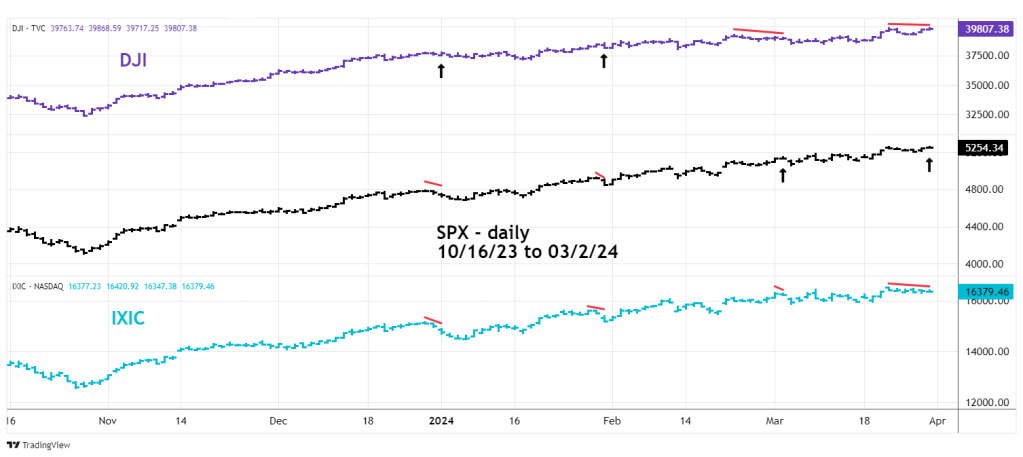

The daily SPX, Dow Jones Industrial Average (DJI), and Nasdaq Composite (IXIC) chart courtesy of Trading View illustrates their relationship.

When only one of the three main U.S. stock indices makes a new/high unconfirmed by the other two indices it could signal a trend change. The “Rule of the Majority” signal can occur at intermediate and major turns.

Since early January there have been three failed signals, 01/02/24, 01/31//24, and 03/04/24. If at least two of the three indices make new all-time highs together, it would invalidate the 03/28/24 signal.

The 15 – minute SPX chart updates its intraday Elliott wave count.

The SPX has completed the presumed Minor wave “5” which began at the 03/19/24 bottom. The high today was 5,264.85 only 10.99 points above Fibonacci resistance at 5,253.86.

At the 03/28/24 high there was a double bearish RSI divergence vs. the 03/21/24 top.

U.S. markets are closed on 03/29/24 for the Good Friday holiday. The 2024 second quarter starts on 04/01/24. A new quarter can sometime coincide with a trend change. Perhaps the beginning of profit taking?