On February 9. 1966 the Dow Jones Industrial Average (DJI) reached 1,001.11, an all-time that terminated a 24 – year secular bull market that began in April 1942. Perhaps the S&P 500 (SPX) could end a 15 – year secular bull market near 5,000 close to or on February 9, 2024.

The daily DJI chart courtesy of Trading view shows what happened in early 1966.

Making a significant peak very close to round number resistance for either the DJI or SPX is rare. The DJI peak made in February 1966 was held until late 1972 to early 1973, topping at 1067.20 in January 1973. Subsequently the DJI did not significantly rise above 1,000 until late 1982.

Also, it’s rare for either the DJI or SPX to make a significant top in the month of February. The only other important February top for the two indices was February 2020.

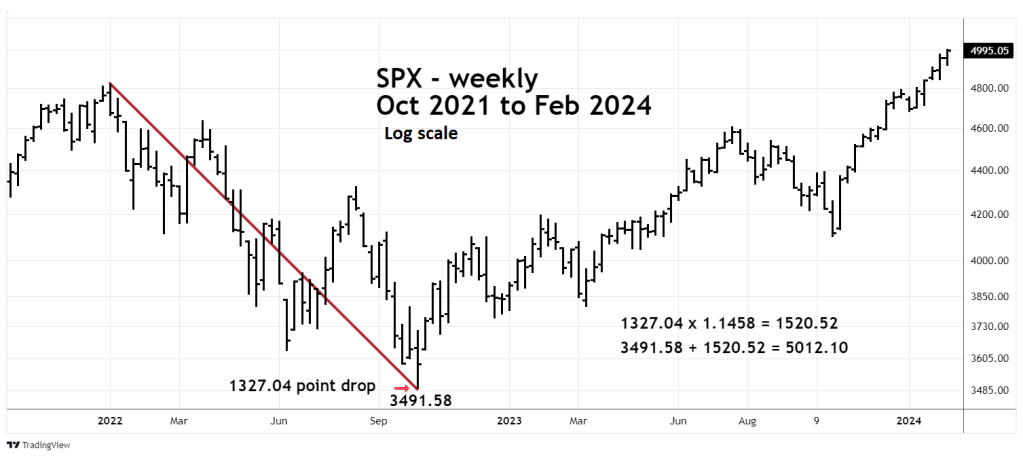

The weekly SPX chart examines the action since the bull market top in January 2022.

The 12/16/23 blog “Projection for S&P 500 – Significant Top” illustrate a very long-term Fibonacci resistance projection. The SPX has now gone above the leeway zone for that resistance projection.

There’s a shorter – term Fibonacci projection where the SPX could find significant resistance.

Several blogs on this website have illustrated that the SPX action from January 2022 to present could be a developing Elliott wave – Expanding Flat. In this structure the second wave marginally exceeds the point of origin of the first wave.

In this situation the point of origin is the January 2022 top.

The first wave down to the October 2022 bottom was 1,327.04 points.

The most common Fibonacci extension of the first wave is the Fibonacci inverse ratio of 1.236. The next most common Fibonacci extension is the Fibonacci inverse ratio of 1.1458.

Multiplying the January to October 2022 drop of 1,327.04 points by 1.1458 equals 1,520.52 points. Adding this to the October 2022 bottom at 3,491.58 targets an SPX peak at 5012.10. This is very close to round number resistance at 5,000.00.

Today 02/07/24 the SPX reached 4,999.89. The SPX intraday Elliott wave pattern suggests a little bit more upside action.