Many times, after a market trend change there’s can be a deep retracement of the new trends first movement. A simple reason why there could be deep retracements – market participants believe the prior trend is still underway.

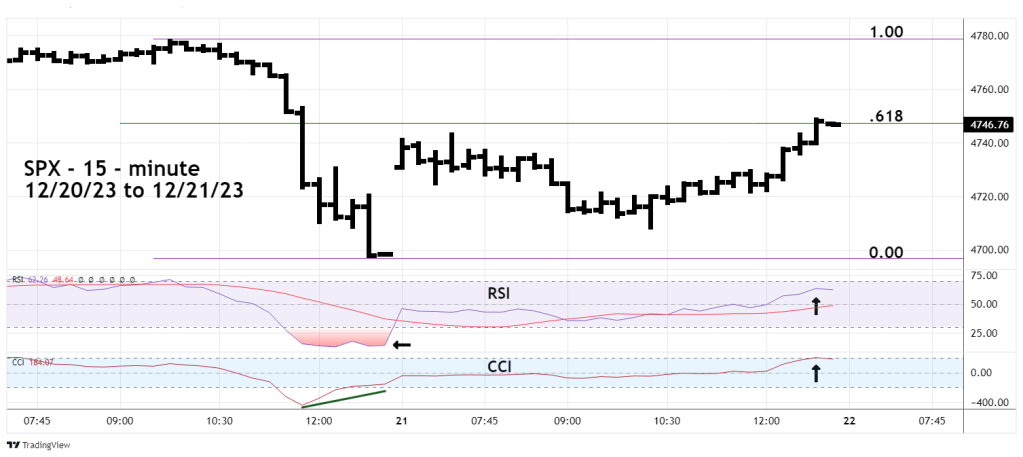

The 15-minute S&P 500 (SPX) chart courtesy of Trading View shows what happened after the sharp and deep drop on 12/20/23.

So far the SPX has retraced in three waves a Fibonacci .618 retracement of the 12/20/23 decline. This is a typical level where retracements could end, in this case there could still be additional upside action.

Note that both RSI and CCI highs of the 12/21/23 rally corresponded with the SPX high. Usually at least one of these price oscillators could have a bearish divergence signaling a potential top. The SPX micro crash bottom on 12/20/23 had a CCI bullish divergence hinting that the bear trend could be exhausted.

Digging under the surface could reveal where the post 12/20/23 rally may terminate.

The 15 – minute S&P 500 – March 2024 E-Mini (ES) courtesy of Ninja Trader illustrates its Volume Profile.

The Volume Profile method aligns market volume with price action. This shows volume clustering in areas of price consolidation. The largest cluster is called Point of Control (POC). Many times, price will gravitate to or move away from POC. If there’s a move beyond POC, price could gravitate to the next volume cluster – which could be a resistance/support point.

If ES – March 2024 moves above its 12/21/23 high it could find resistance near the next price cluster made on 12/20/23. The widest part of this cluster is at about ES – 4812 which roughly corresponds to SPX 4760.

If the SPX continues to rally on 12/22/23 it may stop in the 4758 to 4764 area. A move beyond this zone opens the door for an SPX move to just below the 12/20/23 high.

If the 12/20/23 high is exceeded, the SPX could continue rising until at least the last trading day of 2023.