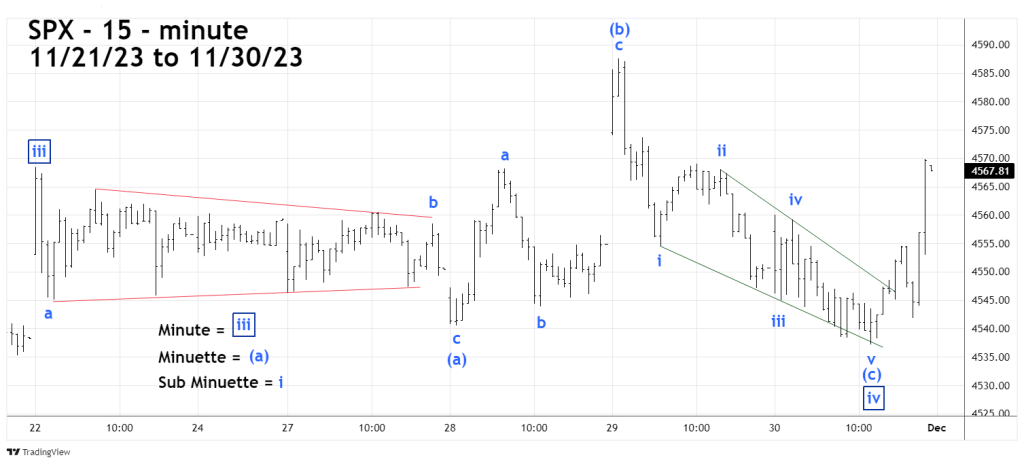

The 11/29/23 blog illustrated the S&P 500 (SPX) appeared have begun an Elliott wave – Ending Diagonal Triangle that began on 11/28/23 at 4,540.51. Today on 11/30/23 the SPX broke below 4,540.51 invalidating the Ending Diagonal Triangle pattern. The SPX move below 4,540.51 was marginal and appears to have completed an Elliott wave corrective pattern.

The 15 – minute SPX chart courtesy of Trading View updates the action.

There are always alternate Elliott wave counts and it appears that on 11/30/23 the SPX completed an Expanding Flat.

Expanding Flats are corrective patterns that divide into three – wave structures. The first wave “A” are themselves composed of three – waves, The second wave “B” is also composed of three waves that terminate beyond the point of origin of wave “A”. The third wave “C” subdivides into five waves and terminates beyond the end point of wave “A”.

The 11/29/23 blog noted that Ending Diagonal Triangles (EDT) only appear in the fifth wave position of motive waves and in the “C” wave position of corrective patterns.

While it appeared a rising EDT was forming from the 11/28/23 bottom, what happened was a declining EDT from the 11/29/23 top to the 11/30/23 bottom.

After completion of EDT’s there’s usually a rapid move back to the EDT point of origin. Just before the close of the 11/30/23 session the SPX retraced more than 62% of the 11/29/23 to 11/30/23 decline. There’s a good chance the SPX could reach the area 11/29/23 high of 4,587 sometime on 12/01/23.

The daily SPX chart courtesy of BigCharts.com illustrates near term momentum.

At the end of the SPX 11/30/23 session the very effective daily Slow Stochastic oscillator was still in a down trend. Assuming the SPX 11/30/23 bottom holds, the daily Slow Stochastic may not reach overbought at 80% until at least 12/04/23.

The broad topping time zone could be 12/04/23 to 12/06/23.