The 10/28/23 blog “Approaching Death Cross” noted that the Dow Jones Industrial Average (DJIA) 50 – day moving average (MA) could cross below its 200 – day MA. This is known as a “Death Cross”. Today 11/01/23 the DJIA moving average lines moved closer to a cross. A very important DJIA top could occur in one or two trading days.

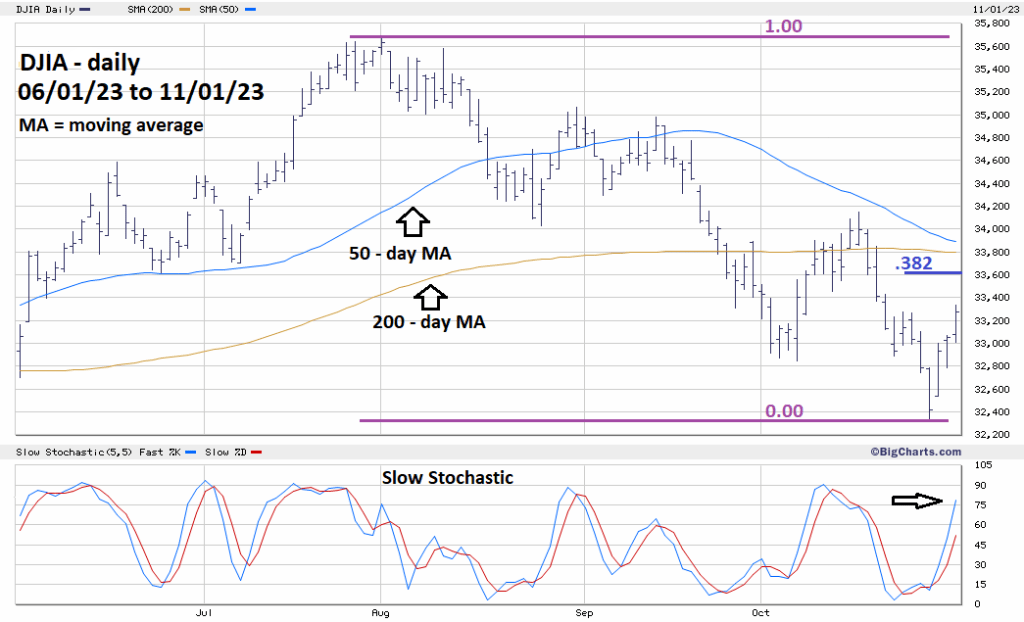

The daily DJIA chart courtesy of BigCharts.com updates the action.

The upper line of BigCharts.com, very effective Slow Stochastic has reached 80% – the boundary of the overbought line. The lower Slow Stochastic could reach 80% within the next two trading days.

Also within two trading days is a Fibonacci .382 retracement of the DJIA – August to October drop. The .382 level is at 33,607. The DJIA 200 – day MA is close to 33,800.

DJIA – 33.600 to 33,800 is the broad topping zone.

If the DJIA can reach this broad zone on 11/02/23 or 11/03/23 it could be a very important top.

Watch the DJIA.