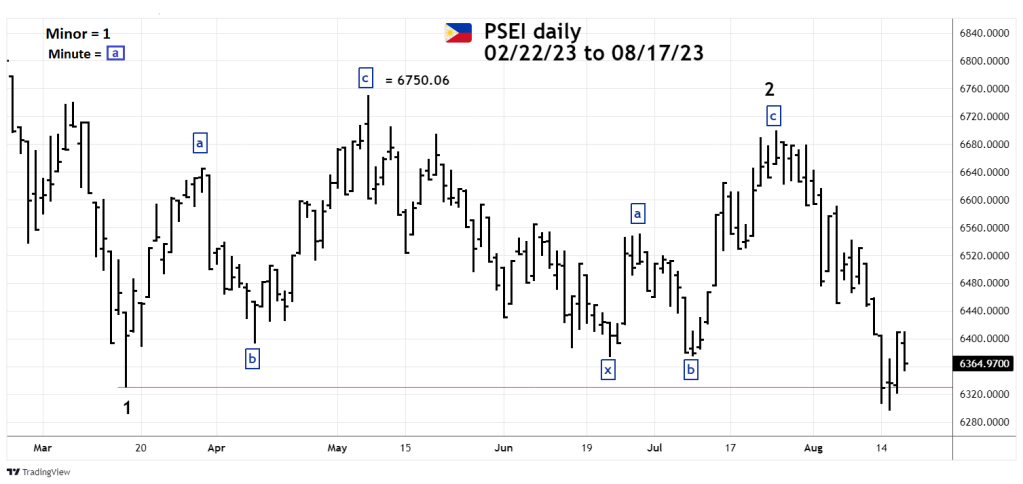

The 07/15/23 blog “Philippine Stock Exchange an Elliott Wave Tutorial” illustrated that the Philippine Stock Exchange (PSEI) could be rising in an Elliott wave – Double Zigzag pattern.

The daily PSEI chart courtesy of Trading View updates the action.

About 85 to 90% of the time the second Zigzag of a Double Zigzag pattern will exceed the termination point of the first Zigzag. In this case it’s the 05/08/23 peak at 6,750.06. It now appears the second Zigzag pattern terminated at the 07/25/23 top at 6,698.41. This is referred to as a truncated wave which can’t be identified until after the fact.

The move down on 08/14/23 which broke below the 03/16/23 bottom indicates that a truncated Double Zigzag is probably complete at the 07/25/23 top.

Truncated waves in a rising market are potentially very bearish. There’s a high probability the PSEI could drop at a minimum to the 5,700 area.

The next daily chart shows the Vietnam 30 (VN30)– stock index.

The 06/29/23 blog “Vietnam 30 Stock Index Hits Powerful Resistance” illustrated that the VN30 had reached three Fibonacci resistance points in the 1,140 to 1,143 area and noted.

“In terms of support/resistance, one Fibonacci coordinate is like a wooded wall. Two Fibonacci coordinates close together can have the strength of a brick wall. When three Fibonacci coordinates are near each other it could be equivalent to a steel wall.”

It takes powerful force to break through three Fibonacci points and that’s what happened. The VN30 has steadily risen about 10% above the resistance zone.

When a market moves beyond Fibonacci resistance/support it tends to gravitate to the next important Fibonacci resistance/support level. In this case it’s a .618 Fibonacci retracement of the November 2021 to November 2022 bear phase.

Daily RSI has a double bearish divergence and MACD – Histogram has a bearish divergence. These momentum signals in proximity to Fibonacci resistance indicates the VN30 could be at or near an important top.

If the VN30 enters a bear phase it has potential to reach the November 2022 bottom sometime before the end of 2023.