Two of the leading stocks during the 2023 rally now appear to be leading the way down.

For decades Apple Inc. (AAPL) has been one of the best performing U.S stocks. During the 2023 bull run AAPL continued to outperform the broader U.S. stock market.

The weekly AAPL chart courtesy of Trading View illustrates its performance since 2021.

During 2023 AAPL gained an amazing 60% and exceeded its prior all-time high made in 2021, something which none of the three main U.S. stock indices have accomplished.

AAPL has a clear Elliott – Impulse wave from January to July 2023. If this pattern is complete it implies at a minimum, a retracement proportionate in price/time to the 2023 rally. The seven-month rally could be retraced in perhaps two or three month. In terms of price AAPL may decline to the 150 area. These are the minimal time/price projections. If AAPL completed an Elliott Impulse wave from its bottom made in January 2009, the subsequent bear phase could continue for years. In terms of price AAPL could ultimately drop 60 or 70% in value from its 2023 peak.

The weekly momentum oscillators imply more downside action.

At the AAPL top RSI had a bearish divergence and has crossed below its weekly moving average line. MACD has bearish line cross. Stochastic also has a bearish line cross and has not reached the oversold zone at 20%.

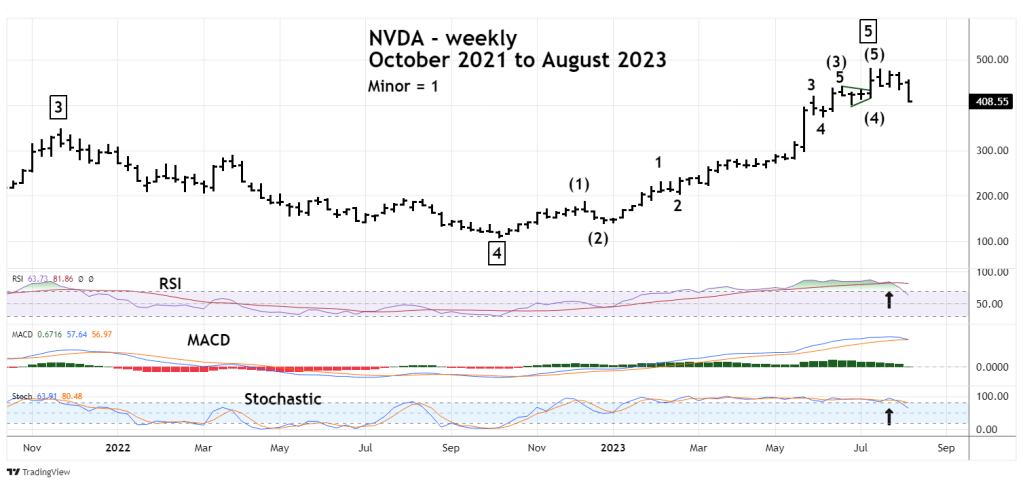

The next weekly chart examines Nvidia Corporation (NVDA) action since 2021.

Since NVDA October 2022 bottom to July 2023 it had a spectacular 350% gain! To accomplish this feat, it formed an extended Elliott Impulse wave.

Note that at the July 2023 peak weekly RSI had no bearish divergence. This phenomenon occurs at blow off tops in commodities and individual stocks. A 350% gain in just nine months qualifies as a blow off top. RSI after the peak has moved below its weekly moving average line.

Stochastic has a bearish line cross. MACD has yet to have a bearish line cross.

AAPL and NVDA are two of the stocks that have been pushing the main U.S. stock indices higher. Even if the fundamentals of these stocks and the U.S. economy are bullish, they are vulnerable to profit taking.

If fundamentals turn or are turning bearish, the need to lock in profits could grow.