The prior blog noted that if the S&P 500 (SPX) broke below the 08/09/23 bottom it could open the door for a move down to the SPX 4,385 to 4,410 area. What happened was a marginal move below the 08/09/23 bottom and another bullish momentum divergence.

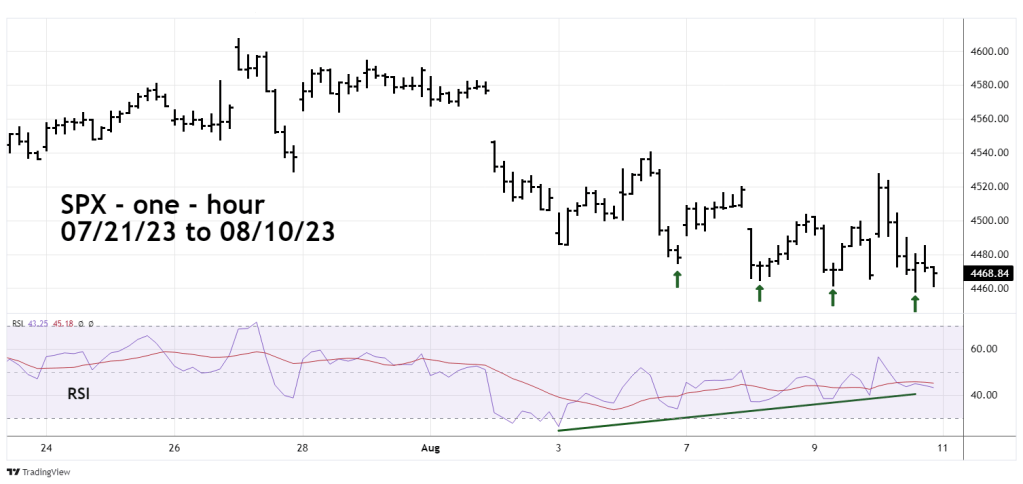

The hourly SPX chart courtesy of Trading View examines the action.

U.S. stocks again rallied early in the session on bullish news and failed to maintain the gains. The subsequent drop wiped out the entire rally from the 08/09/23 bottom. The marginal new decline low created a fourth – hourly – RSI bullish divergence.

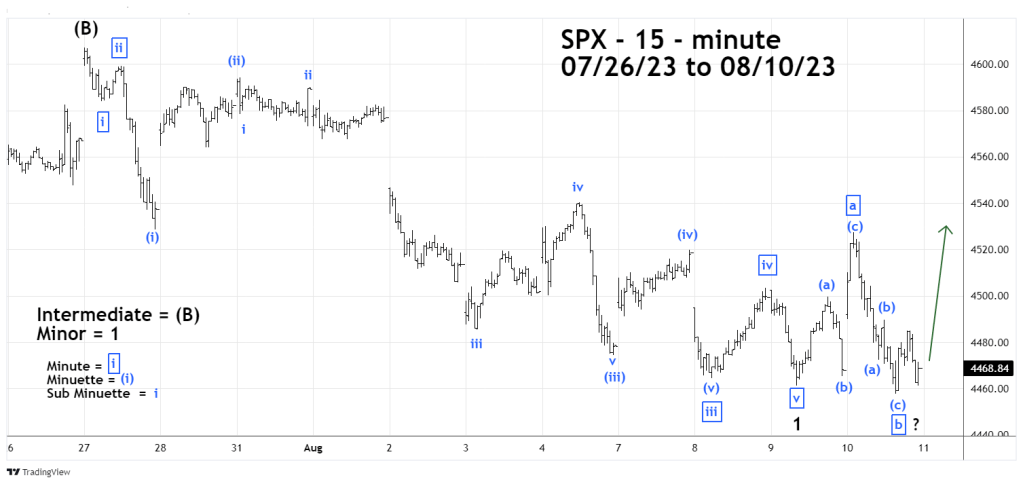

The 15 – minute SPX chart shows what could be happening from an Elliott wave perspective.

The SPX action from the 07/27/23 peak to the 08/09/23 bottom counts best as an extended Elliott wave impulse pattern. The rally from the 08/09/23 bottom to the 08/10/23 high could be the first wave of an Elliott – Inverse Expanding Flat correction. If so the subsequent rally off the 08/10/23 bottom could be Minor wave “C”. The termination point of this rally could be in the area of 4,530 to 4,550.

Note the question mark after the presumed Minute wave “b” boxed – label. Its possible Minute wave “b” could still be developing. If so, there could be another marginal new SPX low made early in the 08/11/23 session. If this develops it could be the starting point for a rally to the 4,530 to 4,550 area.

When markets or stocks have significant trend changes, they usually exhibit abnormal behavior – something different is happening. In this case the “something different” is early session rallies on bullish news followed by sharp intraday reversals. In bullish stock market trends, the early gains are maintained with the rally continuing into at least the next trading day.

The intraday rally failures since the SPX 07/27/23 peak could be subtle clues that a multi-month bear trend has begun.