On 07/13/23 U.S. stocks continued to rally. However, there were small signals that hinted the bears could be ready to pounce.

Both the S&P 500 (SPX) and Nasdaq Composite made new post October 2022 rally highs. This suggests the rally could continue for at least one trading day. The third main U.S. stock index, the Dow Jones Industrial Average (DJI) continues to lag.

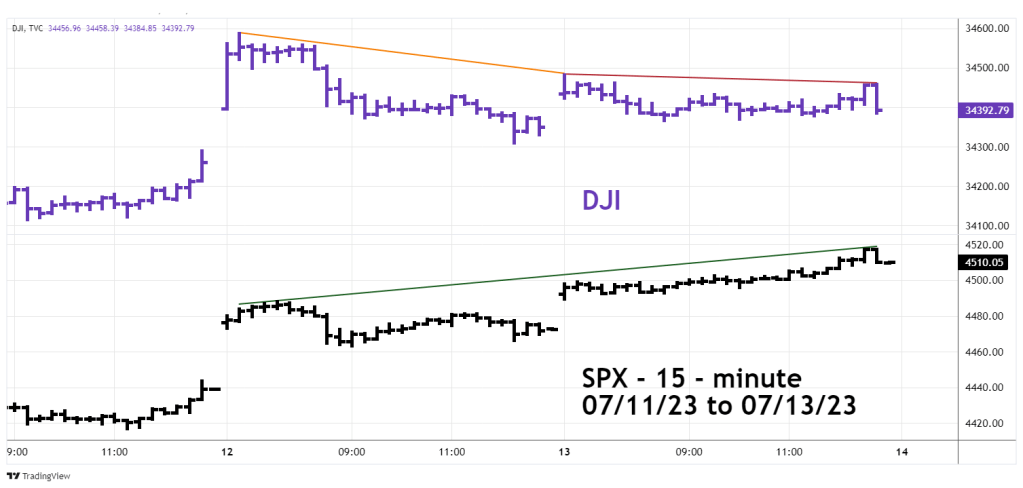

The 15 – minute DJI and SPX chart courtesy of Trading View illustrates their relationship.

On the 07/13/23 open not only did the DJI fail to get anywhere near its 07/12/23 open high, but it also failed to keep pace with the SPX steady 07/13/23 rally.

Considering the powerful move up on 07/12/23 its unusual that the DJI is failing to at least catch up with the SPX. This is not the type of action you would expect in a sustained bull move.

The daily VIX chart shows a continuing bearish signal.

The VIX is still above its 06/30/23 and 06/22/23 bottoms – a VIX topping signal. Additionally, with the SPX up .85% from its prior day close, the VIX ended its session 5-ticks above its 07/12/23 close. Traders are short 100% non-leverage SPX related funds from the SPX open on 07/05/23. Continue holding short with a stop loss on half the position if the SPX goes above 4,550.00.