Today 7/12/23 two of the three main U.S. stock indices moved to new post October 2022 rally highs. The new highs came beyond the leeway time zone for the expected Spiral Calendar top due late June 2023 – illustrated in the 06/22/23 blog. Today’s highs also invalidated Fibonacci price and time relationships shown in the 07/03/23 blog. The long-term Fibonacci time relationship between the S&P 500 (SPX) 1998 and 2018 tops shown in the 06/25/23 blog is still valid. This Fibonacci time relationship could be reexamined, dependent on near-term SPX action.

For at least the short-term, today’s rally implies more upside action in U.S. stocks. This forecast could change depending on readings from two U.S. stock indicators.

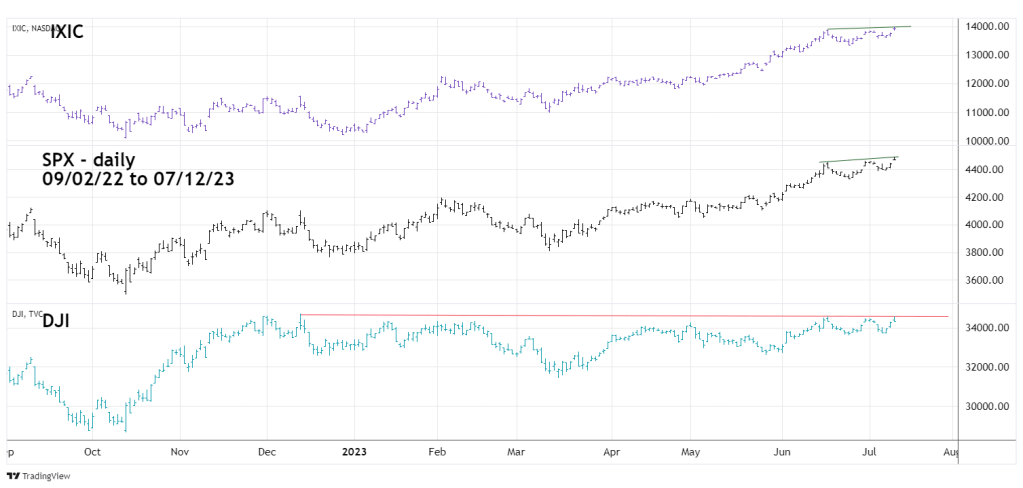

The daily SPX, Dow Jones Industrial Average (DJI), and Nasdaq Composite (IXIC) charts courtesy of Trading View illustrates the first indicator to watch.

Today’s SPX and IXIC new post October 2022 new rally highs invalidated the 06/30/23 bearish “rule of the majority” signal when only the SPX made a new rally high. The bullish trend is likely to continue with at least two of the three main indices making new rally highs.

The DJI continues to be very weak relative to the SPX and IXIC. The DJI has yet to move above its 12/13/22 top and the 06/16/23 peak. Additionally, during today’s session the DJI came close to retracing all of its early day rally.

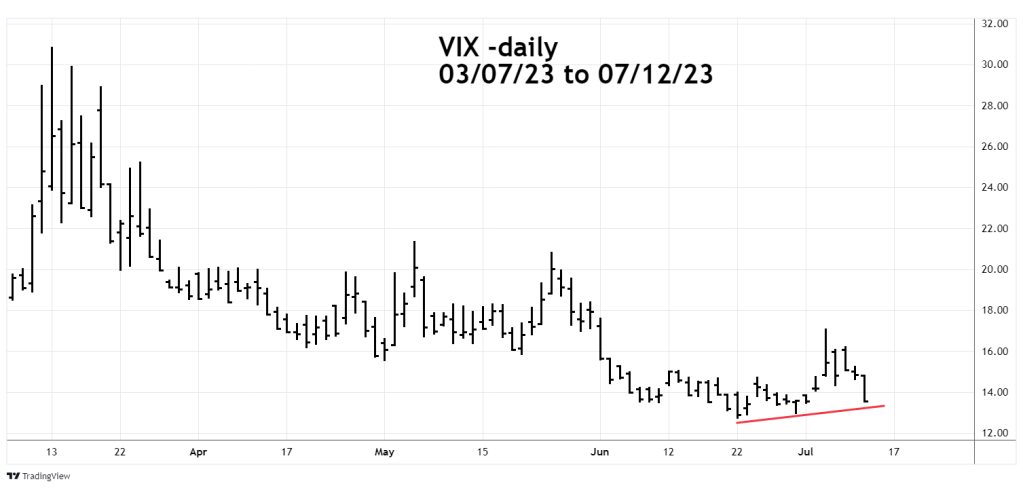

The daily VIX chart illustrates the second U.S. stock indicator to watch.

With the SPX making a new rally high and the VIX at a higher bottom, the VIX topping signal remains valid. If the VIX were to go below its 06/22/23 bottom it would invalidate the bearish signal.

The rally in U.S. stocks could continue for at least the next one to three trading days.

Traders are short 100% non-leverage SPX related funds from the SPX open on 07/05/23. Continue holding short with a stop loss on half the position if the SPX goes above 4,550.00.