The rally in U.S. stocks since the March 2023 bottom has been very selective. While some sectors are lagging, the Technology sector has led the way up. This sector as measured by the SPDR Select Sector Fund – Technology (XLK) has reached the area of its all-time high made in December 2021. A significant double top could be forming.

The daily XLK chart courtesy of Trading View illustrates its history since April 2020.

Perhaps the most common Fibonacci retracement is equality or 1/1. On 06/16/23 XLK was only .74 points away from it peak made on 12/28/21. Its possible the second part of a double top is in place; however, two factors suggest there could be more upside action.

Note the daily RSI has reached its highest level since the rally began in October 2022. Most of the time stock indices reach their ultimate tops with at least one RSI bearish divergence. The final XLK peak in December 2021 had several RSI bearish divergences.

The June 2023 maximum RSI reading implies there could soon be at least a small decline, then another rally into a potential major top.

There could also be a developing time cycle. The October 2022 rally began almost at the same level as the bull move after the 10/30/20 bottom. The prior rally lasted 291 trading days, multiplied by the Fibonacci ratio of .618 equals 179 trading days. The move up from October 2022 has lasted 169 trading days. If the rally were to continue, 179 trading days after 10/13/22 targets 07/03/23 as a potential major peak.

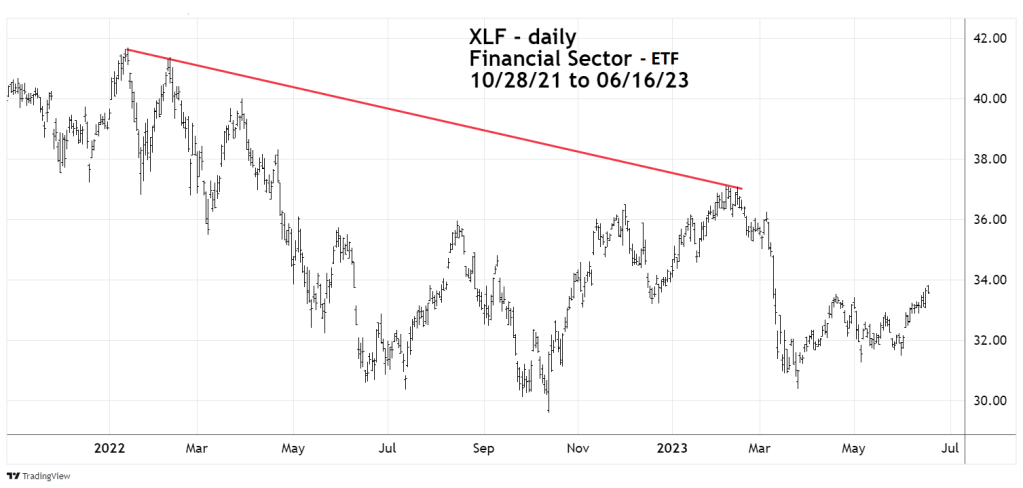

The next daily chart shows the SPDR Select Sector Fund – Financial (XLF).

The difference between the Technology and Financial sectors is shocking! Not only is XLF far from its 2022 all-time high, but it has also only retraced 50% of it drop from the 2023 peak!

The recent maximum RSI reading was deep into the overbought zone above 70% and implies at least a small decline. If XLK makes a new rally high into late June/early July 2023 it could be a major top.

This is no doubt driven by AI hype. Everyone is saying AI is going to be unlike anything we have ever seen before. May go higher when things snap back the exits won’t be big enough

LikeLike

Thanks for the information.

LikeLike