Throughout most of 2020 Zoom Video Communications Inc. (ZM) had outperform the US stock market. Its spectacular upside performance made it not only a market leader but also a star of the bull run.

That situation change after 10/19/20 which was the all-time high for ZM. The first ZM post was on 10/15/20 “Additional Elliott Wave Confirmation”. The next post on 10/17/20 “Profiting From Zoom” noted there could be an opportunity to buy ZM. Subsequently, ZM declined – however the 11/08/20 post “Zoom Update” illustrated that the stock had broken an important support level and not enough evidence to go long or short.

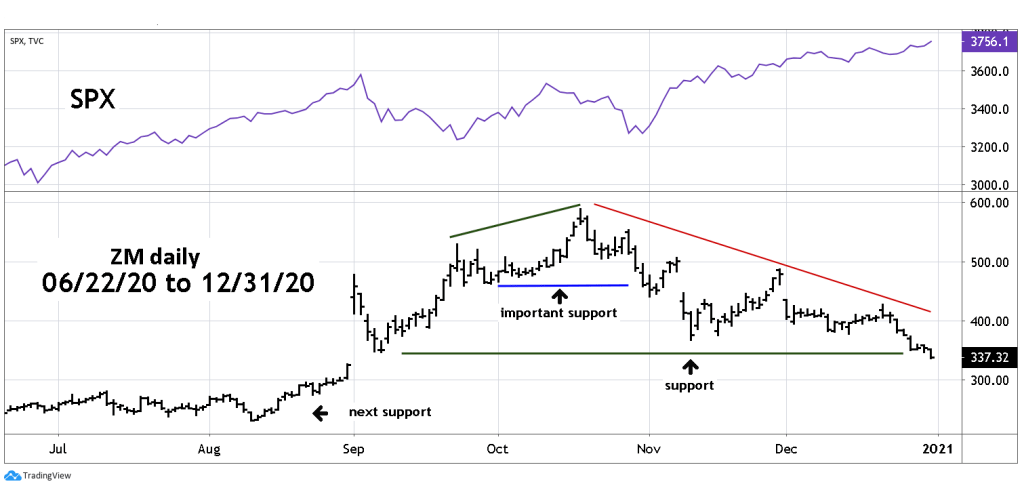

The situation since then has gotten more bearish. On 12/31/20 not only did ZM break another support level, but it also made a new correction low while the S&P 500 (SPX) was making a new all-time high.

The daily ZM chart courtesy of Trading View shows the dramatic underperformance vs. the SPX.

As a bull market ages, fewer stocks make new all-time highs. At some point there aren’t enough stocks making new highs to sustain the bull run. When a market leader/star fails to make new highs it’s a signal of an approaching bear market. ZM is not alone in underperforming the US stock market, and a broader trend change could come in a few months or as soon as a few trading days.

The 12/29/20 post “History of January Stock Market Tops” examined how sometimes either long or short-term peaks can occur in early January.

The first trading week of 2021 could be interesting.

Wow,, Mark, that is interesting info on Zoom! Countless people spend untold hours of their business and even social time on Zoom calls these days. I guess the stock had to drop at some point. Thanks as always for your insight. May your 2021 be healthy and prosperous on all levels!

LikeLike

Thanks for the comment. I hope your new year is great!

LikeLike