Long and short -term UK 100 – RSI readings could forecast the global stock market in 2026.

Stock indices usually have maximum RSI readings at penultimate price peaks. When price reaches its ultimate top, most of the time RSI has a bearish divergence vs. the penultimate peak.

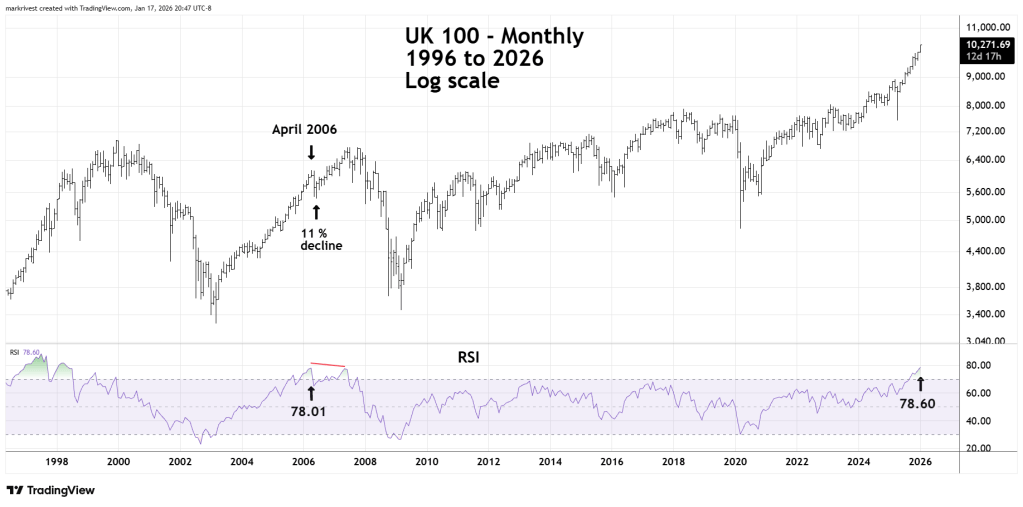

The monthly UK 100 chart – listed in Trading View as FTSE 100 Index Cash illustrates the action from 1996 to 2026.

The current monthly RSI reading is the highest since 1998! Please note the maximum RSI reading in 2006 and the bearish divergence at the ultimate price peak in 2007. After April 2006 penultimate top there was a two-month 11% decline.

Current RSI could climb higher; it reached 88% in 1997. That was the middle of an eight-year technology boom. Today’s bull market is lead by the AI boom and not as broad base as what happened in the 1990’s. The weaker fundamentals are unlikely to repeat the dynamic price movements from 1995 to 1998.

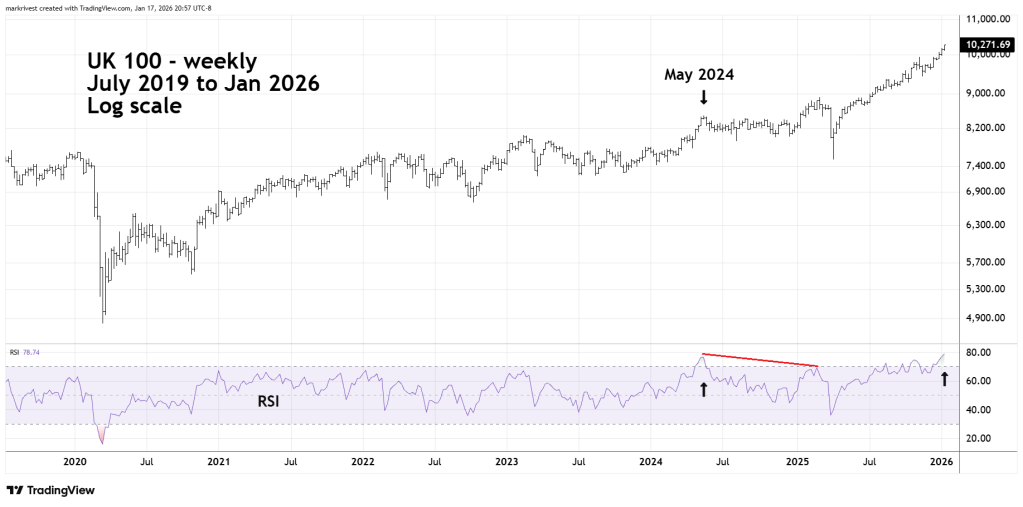

The weekly UK 100 chart looks at what’s happened since 2019.

The most recent weekly RSI reading is the highest since the secular bull market began in March 2020.

The second highest RSI reading occurred in May 2024 which was the prelude to a seven – month sideways correction.

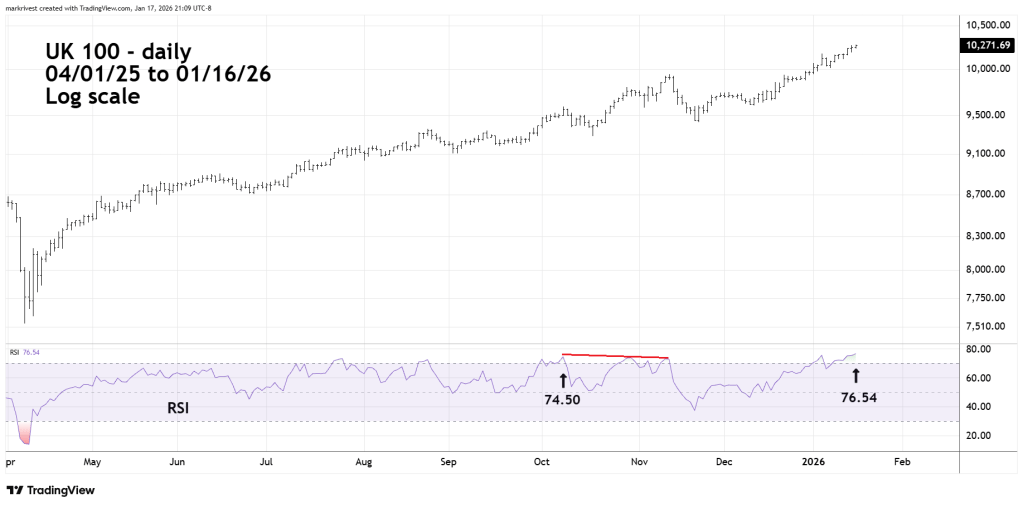

The daily UK 100 chart zooms in on the bull market that began in April 2025.

The RSI reading on 01/16/26 is the highest since the bottom made in April 2025.

The combination of maximum RSI readings on the monthly, weekly, and daily time scales imply UK 100 could begin declining sometime next week.

Based on what happened in 2006 on the monthly scale, a decline could be at a minimum 10% in two – months. Whatever the degree of the decline, there’s a high probability UK 100 could be making highs above current levels sometime later this year.

If this scenario develops there’s a good chance it could also occur in the U.S. stock market and other national stock indices.