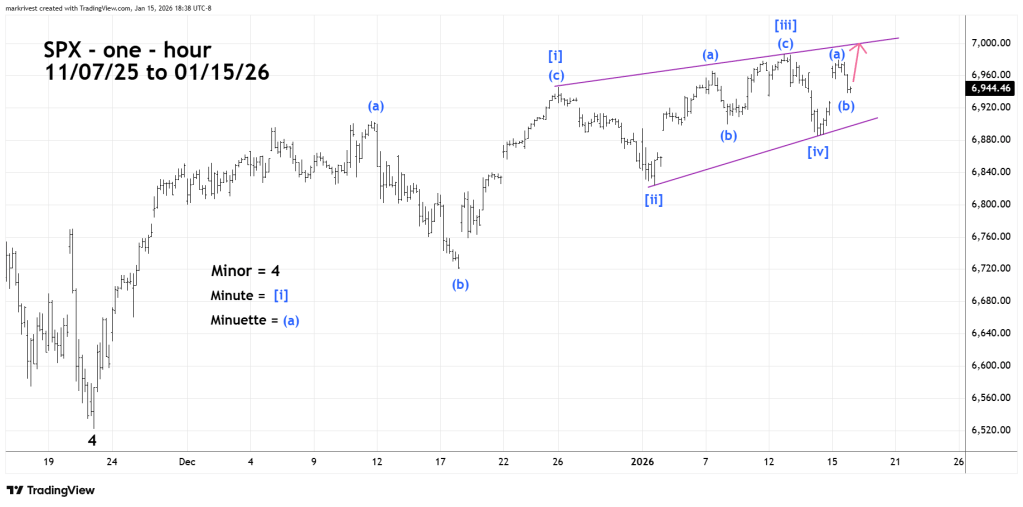

The 01/08/26 blog “Upside Target Reached – 01/08/26” illustrated that the S&P 500 (SPX) could be forming an Elliott wave – Ending Diagonal Triangle. This pattern is still the highest probable wave count, however with a change of the internal wave structure.

The SPX one-hour courtesy of Trading View illustrates the updated wave count.

If this wave count is correct the structure could complete early in the 01/16/26 session.

Price could reach or slightly exceed the upper rising trendline.