Several weeks ago, Microsoft Corporation (MSFT) was the most bullish of the “Magnificent Seven” stocks. Recently MSFT has turned bearish and appears to be headed lower. Meanwhile another Magnificent Seven stock has taken the upside lead. Can this stocks rally hold off a broader U.S. stock market decline?

First a look at MSFT which was last examined in the 08/24/25 blog “Microsoft Update – 08/22/25”

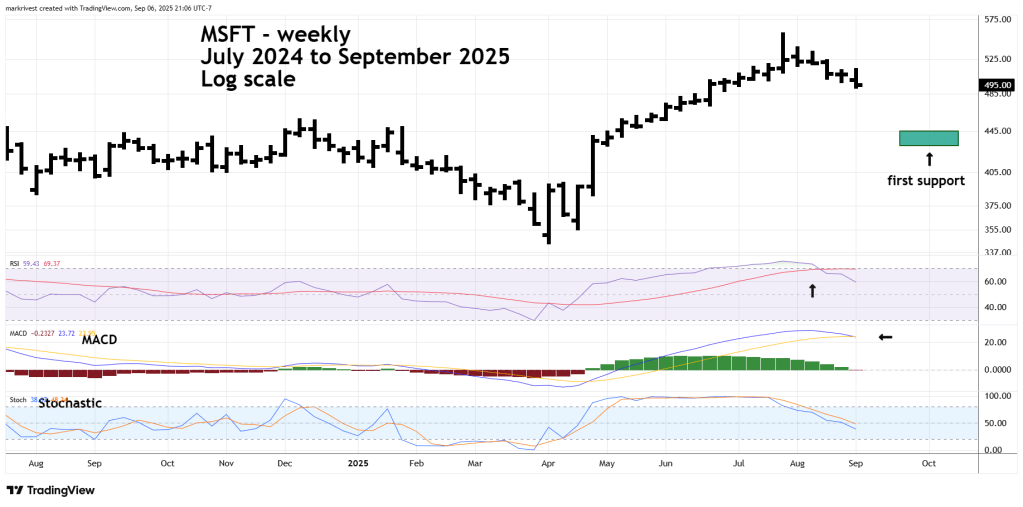

The weekly MSFT chart courtesy of Trading View updates its action.

MSFT now has a bearish line cross and weekly Stochastic is still far from the oversold zone which starts at 30.00. The first support zone is in the 430 to 445 area. MSFT could reach this support in a few weeks.

The next weekly chart examines the action of Alphabet Inc. (GOOGL).

The most bullish aspect of the GOOGL momentum situation is the still rising MACD – Histogram. Usually there’s a Histogram bearish divergence before a significant decline can begin. The same for the weekly RSI which is now deep into the overbought zone above 70.00.

The exception to the current bullish momentum readings would be a blowoff top. If in the next one or two weeks GOOGL makes little or no upside progress, watch 206.20. This is the low for the week ending 09/05/25 and the starting point of the recent spike up. A break below 206.20 could be a very bearish signal.

During the week ending 08/01/25 three of the Magnificent Seven stocks made new all-time highs. Now only one – GOOGL is at an all-time high. If none of the other six stocks develop bullish trends, it’s doubtful GOOGL could sustain the broader U.S. bull market.