When markets undergo a major change in trend there’s usually a dramatic signal, something out of the ordinary that strongly implies a new trend. On 03/04/25 something happened in the U.S. stock market that had not occurred in fifteen – month rally that began in October 2023.

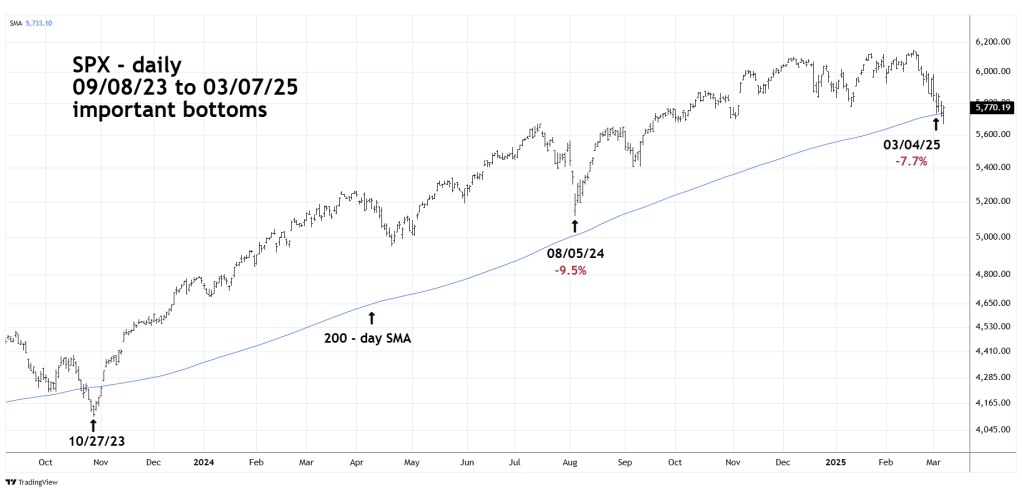

First, we need to get the proper perspective by viewing the daily S&P 500 (SPX) chart courtesy of Trading View.

Since October 2023 there have been two significant declines, the 08/05/24 mini crash and the current drop since 02/19/25.

A case could be made that the 03/07/25 break below the SPX – 200-day Simple Moving Average (SMA) was a dramatic signal. The 200 – day moving average is perhaps the most common tool used to analyze markets. It’s almost a self-fulfilling prophesy. Participants see a market in a bull trend reach the area on or near the 200 – day moving average and buy.

The subsequent move back above the 200-day SMA could be the start of a rally to new all-time highs. However, something much more dramatic happened just prior to 03/07/25.

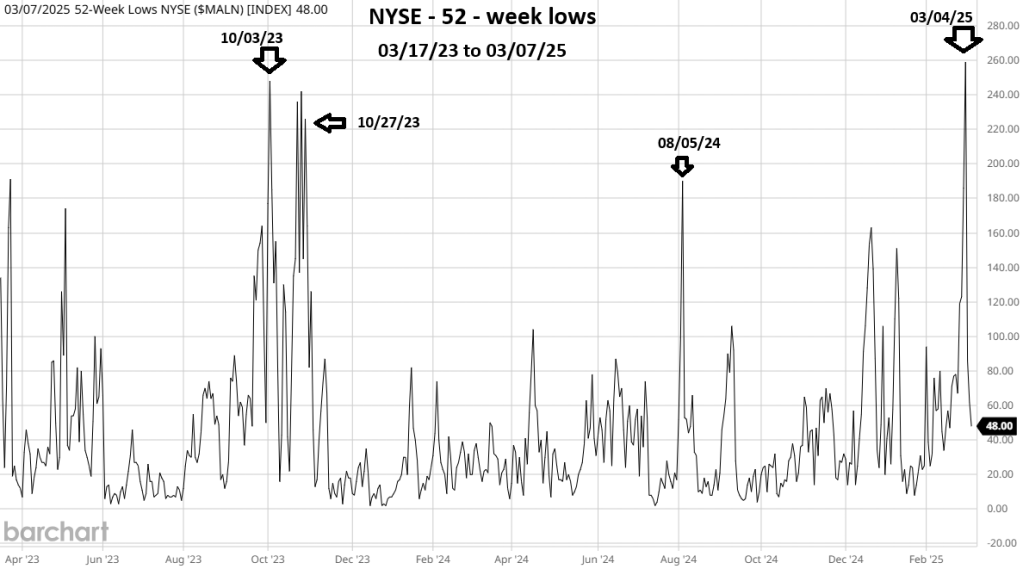

The NYSE – 52 – week lows chart courtesy of Barchart.com shows something mind boggling!

On 03/04/25 the number of NYSE – 52 – week lows exceeded the reading made at the 08/05/24 mini crash bottom. This is amazing because on 03/04/25, SPX from its February high had only dropped 6.7% as opposed to the SPX July to August 2024 decline of 9.5%. Internally the more recent pull back is much more powerful than the July to August drop.

Even more astonishing is that the 03/04/25 NYSE lows are higher than the readings made in October 2023!

On 10/03/23 NYSE maximum downside strength was recorded with 248 lows. The SPX bottomed out on 10/27/23 with 226 lows – a bullish divergence.

Anything can happen in the markets, and we are always testing our hypothesis. The first test comes in the week of 03/10/25 to 03/14/25. If the SPX moves back below its 200 – day SMA and it’s 03/07/25 bottom, there’s a high probability of more downside action.

If this event occurs, we then need to next watch for an SPX – Death Cross which was discussed in this sites prior blog.