In the next few weeks, the S&P 500 (SPX) could have a Death Cross. If so, this could be one of the most important signals for U.S. stocks in 2025.

A Death Cross occurs when the 50 – day moving average of price moves below the 200 – day moving average of price. The inverse is called a Golden Cross which happens when the 50 – day moving average moves above the 200 – day moving average.

For stocks and stock markets prices rise slower than they fall. Therefore, Golden Crosses are usually very effective in signaling multi month or even multiyear stock bull markets.

Because of the rapidity of falling stocks/stock markets, Death Crosses usually signal much shorter movements.

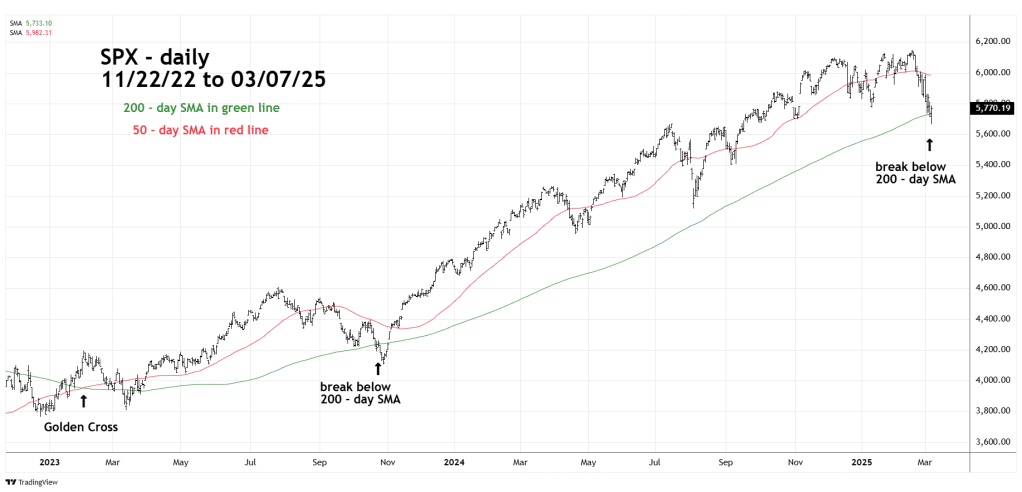

The daily SPX chart courtesy of Trading View illustrates current action regarding the 50 – day and 200 – day moving averages.

Please note that on 03/07/25 the SPX briefly went below the 200 – day Simple Moving Average (SMA). Typically, when a market or stock declines into the 200 – day SMA – bulls could view it as possible support and buy. If the subsequent rally only last one or a few trading days – a decline back below the 200 – day SMA could be a very bearish signal.

Also note that the 50 – day SMA is now rolling over to the downside. It’s possible the 50 – day SMA could cross below the still rising 200 – day SMA sometime in March 2025.

The Golden Cross in February 2023 is a good example of a very effective bull signal.

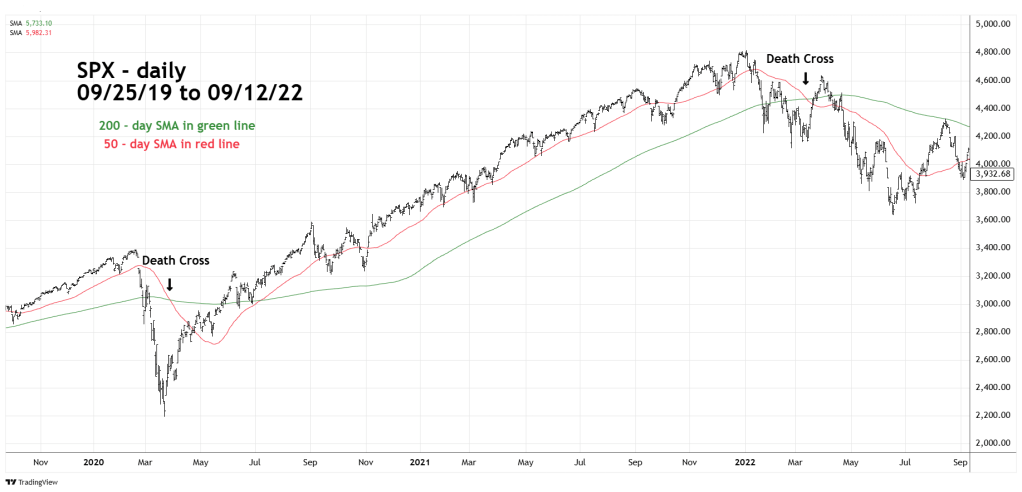

The next daily SPX chart shows the action of the moving averages from 2019 to 2022.

The SPX Covid crash in early 2020 was so fast the Death Cross signal happen after a major bottom was in place.

The Death Cross signal in March 2022 came at a secondary bottom. Note that the subsequent rally failed soon after breaking above the 200 – day SMA. The decline back below the 200 – day SMA was an effective signal for a multi week decline.

Effective Death Cross signals for stock markets usually predict at most 10 to 13 – trading days of down action.

If there is an SPX – Death Cross in March 2025 it could signal a bottom, or that a bottom could soon be made.

Watch the SPX – 50 – day and 200 – day SMA.