Assuming that on 02/19/25 the S&P 500 (SPX) completed a long-term Elliott wave pattern, its possible to forecast the next bear market.

There are two main categories of Elliott waves, Motive and Corrective.

Motive waves represent the main trend and sub divide into five – waves.

Corrective waves retrace the main trend and sub divide into three waves or a combination of three waves.

Corrective waves are in proportion to price and time with Motive waves. For example, if a Motive wave lasted ten trading days the Corrective wave could be three days and retrace 38% of the Motive wave progress.

Or an eleven-month Motive wave could be followed by a Corrective wave of nine months retracing 80% of the Motive wave progress.

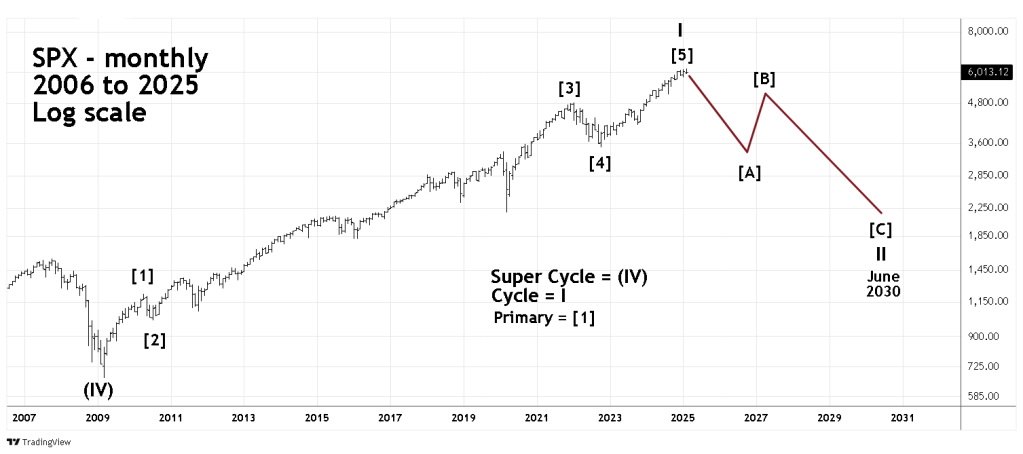

The following SPX charts courtesy of Trading View illustrate two possible long – term scenarios.

The SPX monthly chart shows the Elliott wave count from the major bottom made in March 2009.

In this count the SPX has completed Cycle wave “I” of Super Cycle wave (V). If this count is correct the upward progress from 2009 to 2025 could be just the first part of a secular bull market continuing on into the 2040’s or even the 2050’s.

The projected five – year bear market and retracement are guesses. A Cycle degree bear market could be much smaller or much larger, especially for the time ratio. A good example of a brief bull time ratio is the massive Dow Jones Industrial Average bear market from September 1929 to July 1932.

This bear market lasted close to three – years yet it was correcting about eighty – years of upward U.S. stock market progress. We are subject to the cycles of growth and rest; however, we have free will and have some ability to adjust the cycles.

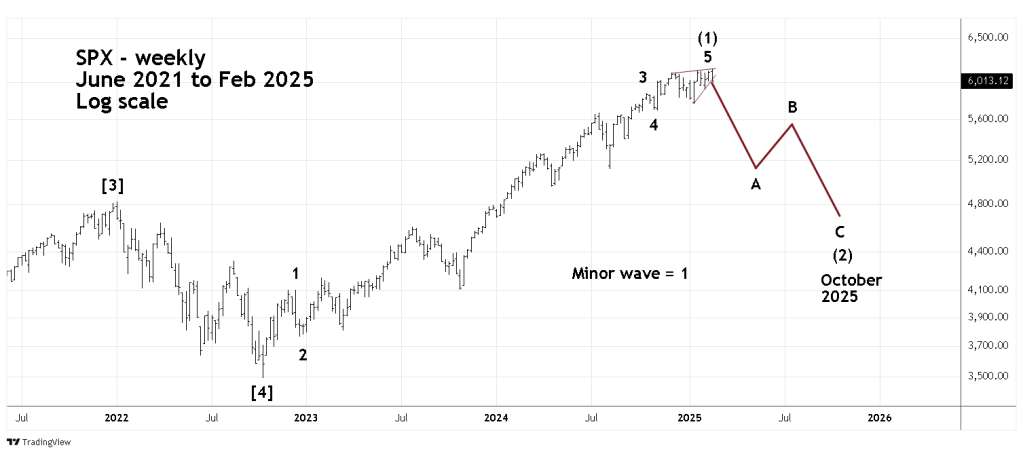

The weekly SPX chart illustrates a smaller potential bear market.

In this scenario the bull move from October 2022 to February 2025 is only Intermediate wave (1) of a still developing Primary wave [5]. If this wave count is correct it would be an extension. The extension phenomenon can occur in any of the three motive sub waves, “one”, “three”, or “five”. Extensions cannot be predicted, this potential extension just like the bear market forecast is a guess.

If this wave count is correct it implies Primary wave [5] could continue into the end of the decade.

This shorter bull market based on U.S. economic fundamentals is the more likely scenario.

Next week this website will examine a theory of what may develop in 2025. Here’s a hint, short- term U.S. economic pain followed by long -term economic gain.