Much of the S&P 500 (SPX) upside performance through 2023 and 2024 has come from the so called “Magnificent Seven Stocks”. These stocks are Alphabet Inc. (GOOGL), Amazon (AMZN),Apple, (AAPL), Meta Platforms (META), Microsoft (MSFT) Nvidia, and Tesla (TSLA).

As of 05/07/24 these 7 stocks made up 29% of the SPX gains. The other 71% was made up of 493 stocks.

Since July 2024 two of the seven stocks have bearish Elliott wave patterns that imply the SPX could soon begin what could be a very severe decline.

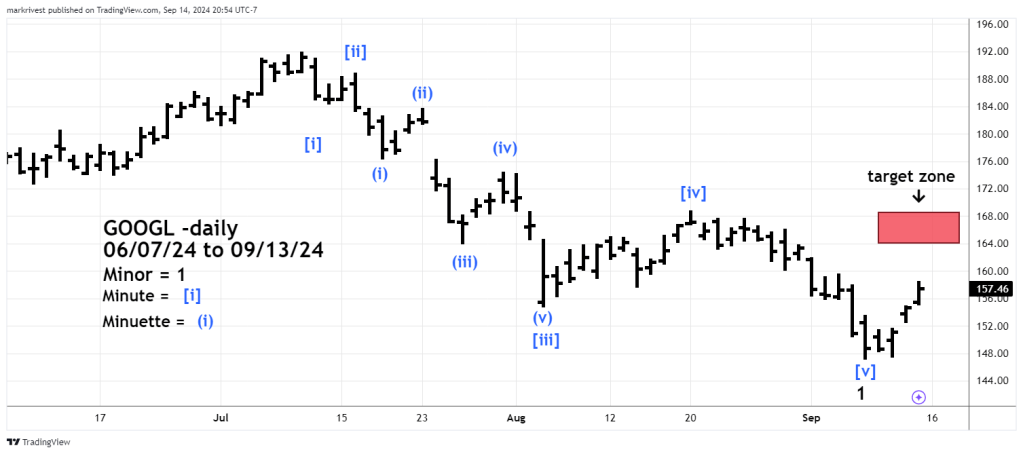

The daily GOOGL chart courtesy of Trading View illustrates its action since its all-time high in July 2024.

From July to September GOOGL dropped more than 23% and has significantly underperformed the SPX.

The decline has taken the form of a five – wave Elliott Impulse pattern. Resistance is the price cluster that formed from mid to late August. If GOOGL peaks in or below this resistance zone it could be the prelude to a very sharp and deep decline.

In Elliott wave terms the next decline could be a third wave which are typically longer than the first wave. The presumed first wave labeled Minor wave “1” fell 23%. If GOOGL has another drop perhaps it could fall 30% or 40%.

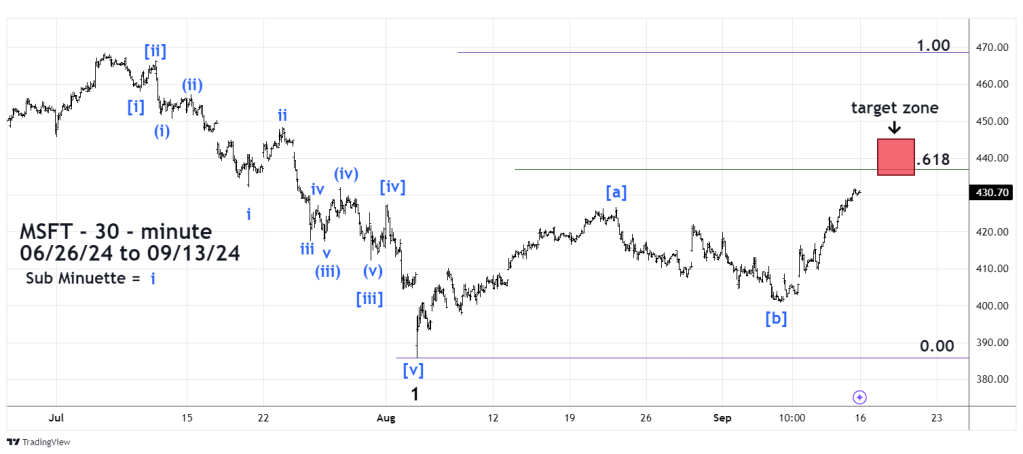

The 30 – minute MSFT chart shows what happened after its all-time high in July 2024.

MSFT’s smooth and steep July to August 17% decline has the distinctive look of an Elliott Impulse pattern. The wave count on the 30 – minute chart confirms this theory. The movement up from the August bottom is a distinctive Elliott – Single Zigzag corrective pattern.

If the wave count is correct the post August rally could be labeled Minor wave “2”. Typically wave “two’s” correct about .618 of the progress of wave one’s.

The upper end of the resistance zone is where the presumed Minute wave [c] would equal Minute wave [a].

If MSFT peaks below or in the resistance zone, its next decline could be greater than 17%.

The U.S. – FOMC makes their next interest rate decision on 09/18/24 which is widely expected to be a cut of .25 basis points.

The reaction of GOOGL and MSFT to this announcement could have consequences for the broader U.S. stock market.