The recent Russell 2000 (RUT) upsurge could soon end.

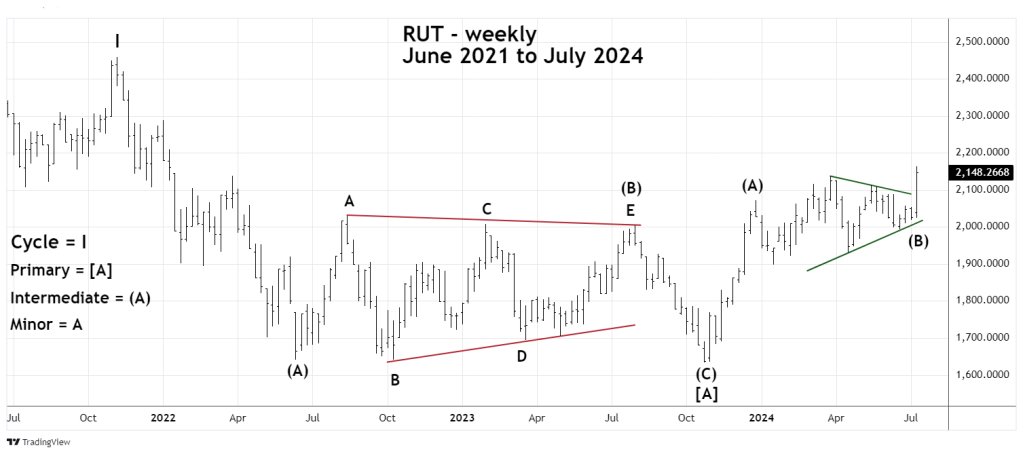

The weekly RUT chart courtesy of Trading View illustrates the long-term Elliott wave count.

The best Elliott wave count for the November 2021 to October 2023 decline is a Single Zigzag corrective pattern. Note that the mid portion of the bear market labeled Intermediate wave (B) took the form of an Inverse Horizontal Triangle.

The bull phase that began in October 2023 could also be a developing Zigzag corrective pattern. The presumed mid phase labeled Intermediate (B) appears to be a Horizontal Triangle.

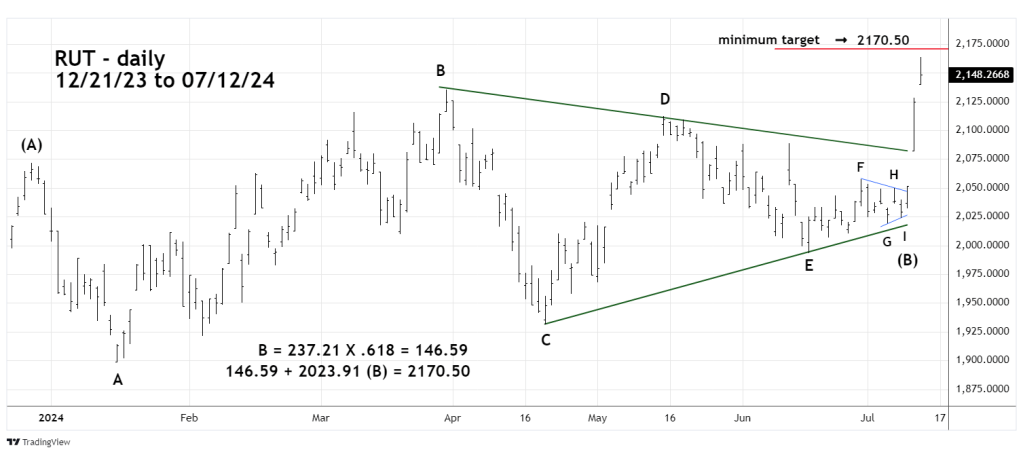

The daily RUT chart zooms in on the action since December 2023.

Horizontal Triangles are corrective patterns when the main trend is up. Inverse Horizontal Triangles are corrective patterns when the main trend is down. They are sideways corrections that normally subdivide into five – waves labeled (A, B, C, D, E). On rare occasions they could subdivide into nine – waves. In that situation the wave “E” subdivides into a smaller five – wave Horizontal or Inverse Horizontal Triangle.

The action from late December 2023 to July 2024 counts as a nine – wave Horizontal Triangle. After completion of an Inverse Horizonal Triangle or Horizontal Triangle there’s frequently a thrust in the direction of the main trend, which in this case is up.

After the 07/09/24 bottom labeled “I” of (B) there’s been a powerful trust up. Typically, a post triangle trust can be measured by the length of the widest part of the triangle. In this case its Minor wave “B” which was 237.21 points. Adding this amount to the Intermediate wave (B) bottom of 2.023.91 targets a top near 2,261.12.

However, short-term momentum suggests a peak could come at a lower level.

Multiplying 237.21 by the Fibonacci ratio of .618 equals 146.59 added to 2,023.91 targets 2,170.50. The RUT high on 07/12/24 was 2,163.60.

It’s possible the manic surge up since 07/09/24 could terminate in a few trading days.