On 07/05/24 the S&P 500 (SPX) rallied .55% and made a new all-time high. The Nasdaq Composite (IXIC) rallied .90% and made a new all-time high. On the same day only 35% of NYSE stocks advanced while 63% of stocks declined. The Nasdaq had 43% of stocks advance vs. 54% decline. Not the first instance of this phenomenon in 2024.

The 2024 rally could have the fewest number of stocks participating in the history of U.S. bull markets.

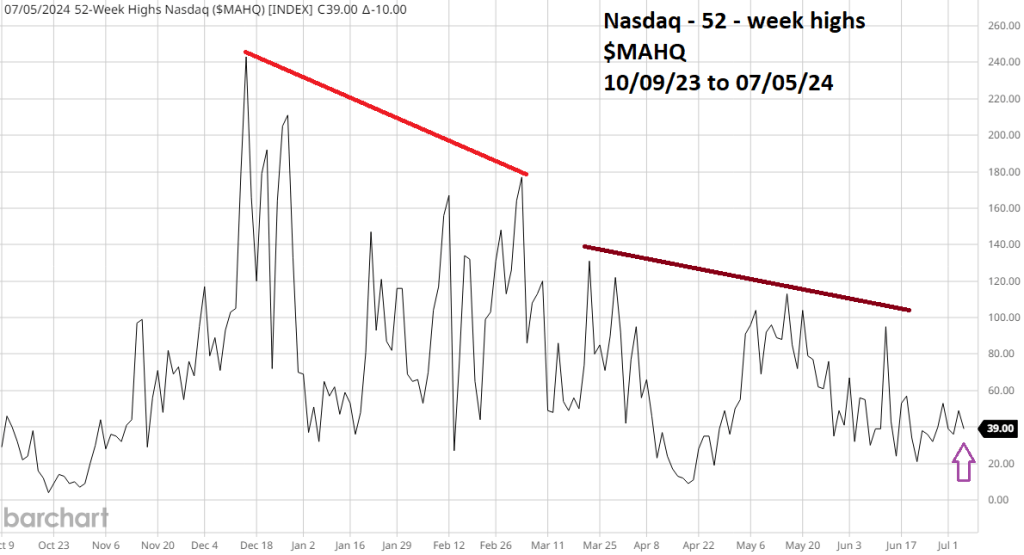

The daily Nasdaq new 52 – week high chart ($MAHQ) courtesy of Barchart.com reveals shockingly bearish evidence.

While the IXIC had a strong .90% rally and made a new all-time high, the number of Nasdaq 52 – week highs declined! This comes after months of multiple and worsening bearish divergences.

Throughout 2024 this website has illustrated weekly and daily bearish divergences between the SPX and the small cap Russell 2000 (RUT). The 5 – minute SPX and RUT courtesy of Trading View illustrates intraday bearish divergences.

From 07/03/24 to the early part of 07/05/24 the SPX had a strong rally while RUT had a strong decline!

The bearish divergences we’re witnessing in the U.S. stock market are not normal, they are extraordinarily abnormal!

The massive bearish divergences of 2024 could be the prelude to a deep sustained bear market.