The intraday Russell 2000 (RUT) Elliott wave count implies more downside action.

Since their late March 2024 peaks to their respective lows the three main U.S. stock indices have declined as follows.

Nasdaq Composite down 2.9%.

S&P 500 down 3%.

Dow Jones Industrial Average down 5%.

Looking beyond the three main U.S. stock indices, the Russell 2000 – small cap stocks has fallen 6.6%.

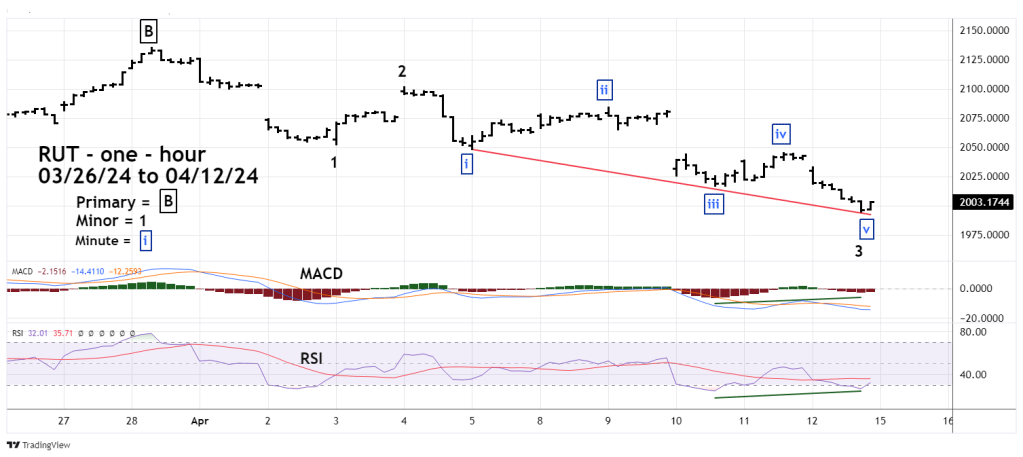

The one – hour RUT chart courtesy of Trading View zooms in on the decline since late March.

It appears RUT is forming an Elliott five – wave Impulse pattern.

Note that the presumed Minor wave “3” has a clear five wave Impulse pattern, this is referred to as an extension which is common in the third waves of stocks and stock indices.

If this wave count is correct, RUT could soon have shallow rally lasting perhaps one to three trading days. If this occurs it could be Minor wave “4” followed by a decline below the 04/12/24 bottom to complete the five wave Impulse down.

There are always alternate Elliott wave counts. A more bearish scenario has the presumed Minor wave “3” as just the first wave of a still extending Minor wave “3”. If this were to occur there would still be a shallow rally, but the subsequent decline could be very powerful and steep, perhaps as much as 5% in one day.

The bullish scenario has the 03/28/24 to 04/12/24 decline as a three- wave corrective pattern. In this case the 04/04/24 peak at 2,101.46 would be the mid portion of a presumed Single Zigzag correction. The labeling of this peak would change from Minor wave “2” to Minor wave “B”.

A move above 2,101.46 opens the door for a rally back to the 03/28/24 high of 2,135.45 and perhaps beyond.

Traders are short 100% non-leveraged Russell 2000 funds from the open of the 04/01/24 RUT session. Use a move above RUT 2,102.00 as a stop loss for half of the position. Use a move above RUT 2,137.00 a stop for the second half of the position.