Today 02/13/24 the monthly U.S. CPI report was released and the numbers where higher than expected, triggering a large selloff for U.S. stocks. For those who recently went long U.S. stocks this news was probably an unpleasant surprise. Powerful signals from U.S. stock market sentiment and momentum indicators have been bearish for several weeks. Perhaps the readings from market indicators are the real news.

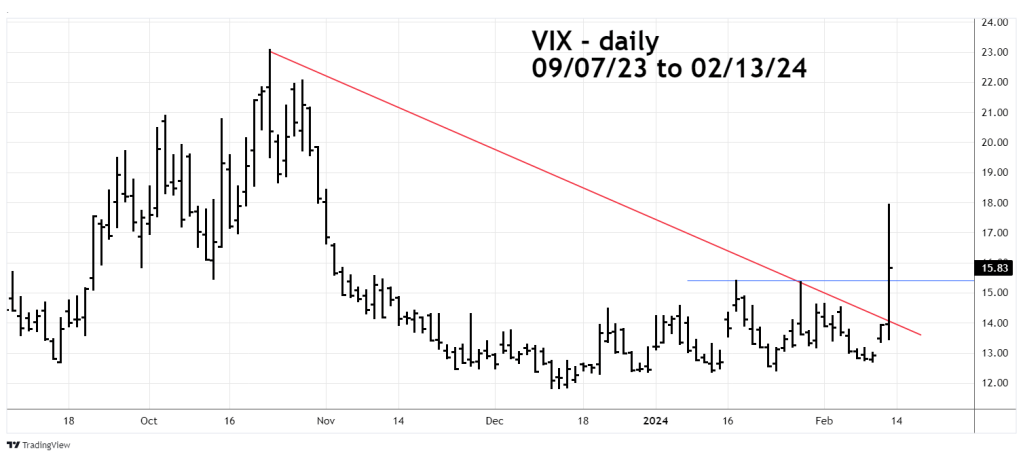

The daily VIX chart courtesy of Trading View updates this important sentiment indicator.

The 02/10/24 blog “U.S. Stock Market Momentum and Sentiment – 02/09/24” noted.

“Two actions to watch for. First, a VIX movement above the declining trendline from the 01/29/24 peak. Second, VIX exceeding the high at 15.40 made on 01/17/24. If both these events occur it could be a signal for a significant SPX decline”.

Today the VIX moved above both levels and it’s the biggest move up since the S&P 500 – September to October 2023 – 9.5% decline.

The S&P 500 may have begun a multi – week- 9 to 10% decline.